Nonprofit organizations play a vital role in addressing societal needs, often operating with limited financial resources. One significant expense they face is providing health insurance for their employees. Understanding how much nonprofits pay for health insurance, the factors influencing these costs, available government assistance, comparisons with for-profit entities, and identifying insurance providers offering favorable rates is crucial for nonprofits aiming to balance employee welfare with fiscal responsibility.

Factors Influencing Health Insurance Costs for Nonprofits:

Several elements affect how much do nonprofits pay for health insurance:

- Organization Size: Smaller nonprofits often lack the bargaining power to negotiate lower premiums, leading to higher per-employee costs. Conversely, larger organizations can leverage their size to obtain more favorable rates.

- Employee Demographics: The age, health status, and family composition of employees can impact premiums. A workforce with older employees or those with dependents may face higher insurance costs.

- Plan Selection: The type of health insurance plan chosen—such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), or High-Deductible Health Plans (HDHPs)—affects both premiums and out-of-pocket expenses.

- Geographic Location: Regional variations in healthcare costs and state regulations can influence insurance premiums.

- Administrative Costs: Nonprofits may incur additional expenses related to managing health benefits, especially if they lack dedicated HR personnel.

Government Subsidies and Programs Assisting Nonprofits Understanding how much nonprofits pay for health insurance also involves exploring government programs designed to alleviate costs:

- Small Business Health Care Tax Credit: Nonprofits with fewer than 25 full-time equivalent employees, paying average wages below a certain threshold( in 2024, this threshold is $55,000 per FTE employee (adjusted annually for inflation), and contributing at least 50% toward employee premiums may qualify for this credit. For tax-exempt employers, the credit can cover up to 35% of premium expenses.

- State-Specific Programs: Some states offer initiatives to assist small employers, including nonprofits, in providing health insurance. These programs vary by state and may include premium assistance or access to group purchasing arrangements.

Comparing Health Insurance Costs: Nonprofits vs. For-Profit Organizations The financial dynamics between nonprofit and for-profit organizations can lead to differences in how much nonprofits pay for health insurance:

- Profit Margins: For-profit entities may have higher profit margins, enabling them to absorb insurance costs more readily or offer more comprehensive benefits.

- Tax Considerations: Nonprofits benefit from tax-exempt status, but they do not have access to certain tax deductions available to for-profit companies, potentially impacting their net insurance expenses.

- Resource Allocation: Nonprofits often prioritize programmatic spending over administrative expenses, which can limit the funds available for employee benefits.

Health Insurance Providers Catering to Nonprofits

Some insurance providers and intermediaries specialize in offering tailored plans for nonprofits, helping to determine how much do nonprofits pay for health insurance:

- PEO4YOU: This organization offers healthcare benefits to independent contractors and small businesses, including nonprofits that may not qualify for traditional group insurance plans due to their size. PEO4YOU provides comprehensive health plan solutions, encompassing essential benefits like preventive care, specialist visits, and prescription coverage, with additional options for dental and vision care. Their services are designed to be affordable and accessible, leveraging partnerships to offer competitive rates.

- Nonprofit Insurance Programs: Various programs and associations focus on the unique needs of nonprofits, offering group purchasing options and plans that consider the financial constraints typical of these organizations.

Strategies for Nonprofits to Manage Health Insurance Costs

To effectively manage and potentially reduce how much do nonprofits pay for health insurance, they can consider the following strategies:

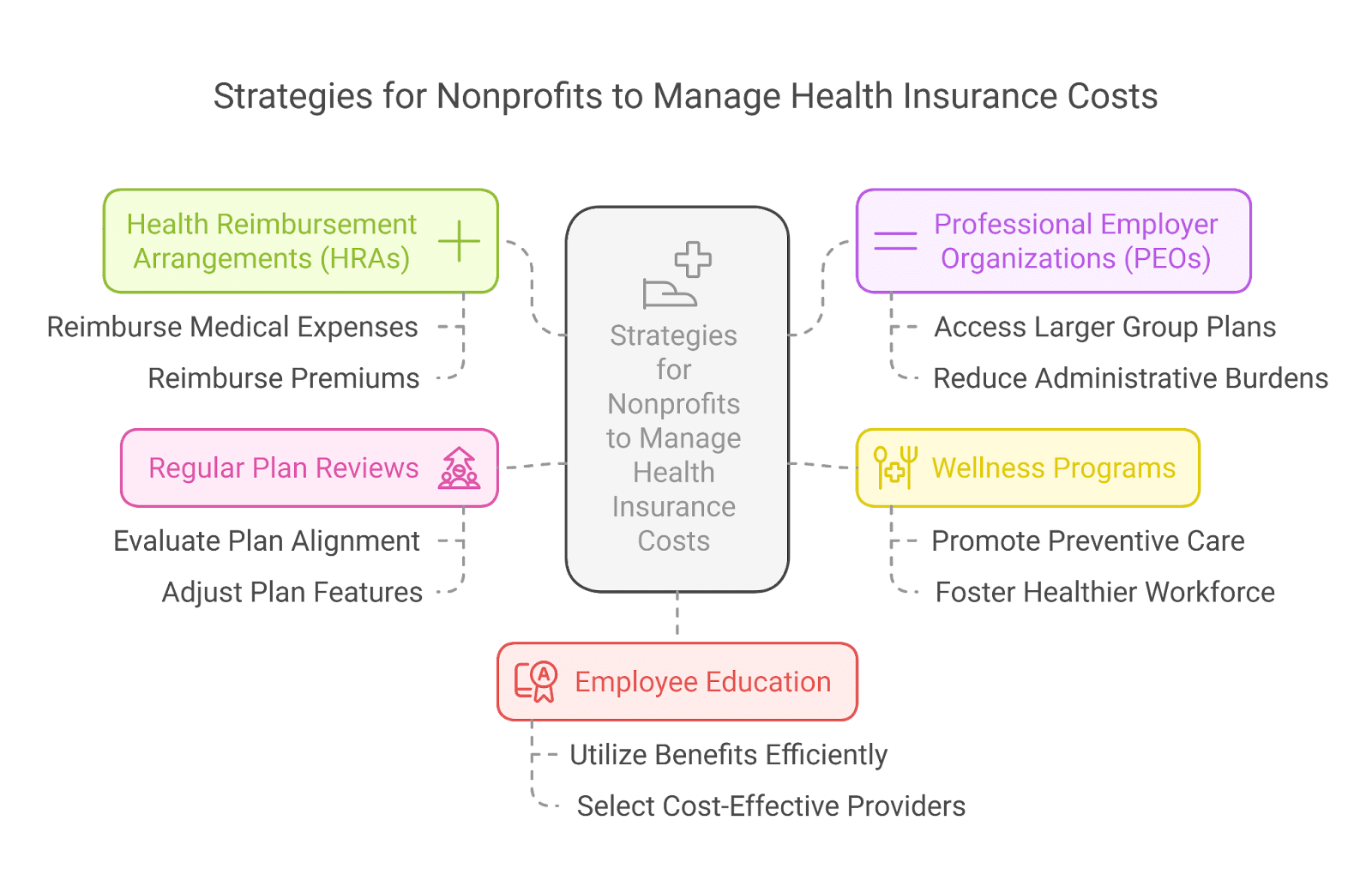

- Explore Health Reimbursement Arrangements (HRAs): HRAs allow employers to reimburse employees for medical expenses and individual health insurance premiums, providing flexibility and potential cost savings. This approach can be particularly beneficial for nonprofits seeking to offer health benefits without the financial commitment of traditional group plans.

- Partner with Professional Employer Organizations (PEOs): Collaborating with PEOs can grant nonprofits access to larger group health plans, often at reduced rates, by pooling employees with those of other organizations. This partnership can also alleviate administrative burdens associated with benefits management.

- Implement Wellness Programs: Promoting employee health through wellness initiatives can lead to lower healthcare costs over time. Healthier employees typically require less medical care, which can reduce the organization’s overall insurance claims and potentially lower premiums.

- Regularly Review and Adjust Plans: Nonprofits should periodically assess their health insurance offerings to ensure they align with employee needs and organizational budgets. Adjusting plan features, such as increasing deductibles or co-pays, can help control premium costs.

- Educate Employees: Providing employees with information on how to effectively use their health benefits, including choosing cost-effective providers and understanding preventive care options, can lead to more informed decisions and cost savings for both employees and the organization.

Mastering How Much Do Nonprofits Pay for Health Insurance: Key Insights for Financial Sustainability

Navigating how much do nonprofits pay for health insurance is a complex yet essential task for nonprofits committed to supporting their employees while maintaining financial health. By understanding the factors influencing insurance expenses, exploring available government programs, comparing costs with for-profit entities, and partnering with specialized intermediaries like PEO4YOU, nonprofits can make informed decisions that benefit both their workforce and their mission. PEO4YOU, in particular, offers tailored health plan solutions that cater to the unique needs of small businesses and nonprofits, providing access to comprehensive benefits that might otherwise be unattainable. Their focus on affordability and comprehensive coverage makes them a valuable partner for nonprofits striving to offer quality health benefits in a fiscally responsible manner.