Health coverage is vital for obtaining necessary medical care, but millions of Americans remain uninsured despite efforts to make healthcare more accessible. In the U.S., certain groups continue to struggle with gaps in coverage, resulting in financial hardships and reduced access to healthcare. In this article, we’ll explore who these groups are, the reasons behind their lack of insurance, and how individuals can take steps to buy health insurance that fits their needs.

This issue, exacerbated by rising healthcare costs and ongoing changes to healthcare policies, affects diverse populations across the nation. Understanding who is most at risk can help shape better strategies for ensuring comprehensive coverage for all.

Populations Most Affected by Lack of Health Insurance

- Immigrant Communities

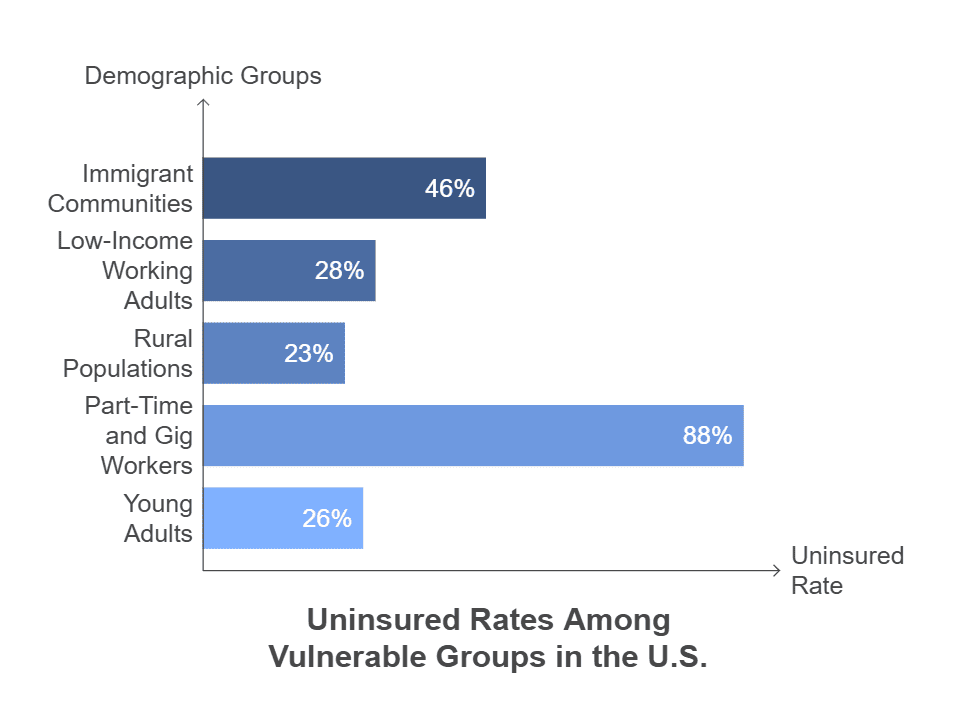

According to recent reports by the Kaiser Family Foundation (KFF, 2023), approximately 46% of non-citizen immigrants in the U.S. are uninsured, compared to just 8% of native-born citizens. Non-citizens often face eligibility barriers for public programs such as Medicaid or CHIP, especially in states that have not expanded Medicaid. Even when eligible, cultural barriers discourage many immigrants from pursuing coverage.

- Low-Income Working Adults

While programs like Medicaid address some needs, gaps remain for low-income adults who earn slightly too much to qualify for Medicaid but cannot afford private plans. A 2024 report highlights that over 28 million individuals fall into this group, often referred to as the “coverage gap” (Urban Institute, 2024). Many are employed in industries that do not offer employer-sponsored health benefits, such as retail, agriculture, and hospitality.

- Rural Populations

Rural Americans experience unique challenges when trying to buy health insurance. A 2023 study by the University of Michigan (UMich Health, 2023) shows that uninsured rates in rural areas are significantly higher than in urban centers. Contributing factors include fewer employment opportunities offering insurance, long travel distances to providers, and limited access to internet resources for navigating enrollment.

- Part-Time and Gig Workers

As of 2024, the rise of the gig economy has left millions of part-time workers without employer-sponsored health insurance. Companies like Uber, Lyft, and DoorDash classify workers as independent contractors, excluding them from benefits. A 2023 survey found that only 12% of gig workers had employer-sponsored plans, leaving many to navigate the complexities of individual health insurance markets on their own (Economic Policy Institute, 2023).

- Young Adults

Young adults aged 26 to 34 represent one of the highest uninsured demographic groups, according to a 2024 report by the U.S. Census Bureau (Census, 2024). Many in this age group “age out” of their parents’ insurance plans at 26 and do not transition to their own coverage due to cost concerns or lack of perceived necessity, particularly if they are healthy.

Reasons Behind the Health Coverage Gap

Access to health insurance remains a challenge for millions of Americans. While programs like Medicaid and the Affordable Care Act (ACA) aim to close the coverage gap, there are still several key reasons why many remain uninsured. Here are some of the main factors contributing to this issue:

Rising Premiums

- Health insurance premiums have steadily increased over the past few years, making coverage unaffordable for many, especially low- and middle-income families.

- A 2023 report indicated that the average premium for employer-sponsored family health coverage reached approximately $24,000 annually, with employees contributing nearly $6,000 out of pocket.

- As premiums rise, individuals are often discouraged from buying health insurance, as they struggle to afford both monthly premiums and out-of-pocket costs.

Medicaid Non-Expansion

- As of 2024, twelve states have not expanded Medicaid under the Affordable Care Act (ACA).

- This leaves millions of low-income individuals without access to affordable health insurance.

- States like Texas and Florida have high uninsured rates due to the lack of Medicaid expansion, disproportionately affecting minority communities and low-wage workers.

- Without Medicaid expansion, many individuals in these states are stuck in the “coverage gap,” earning too much to qualify for Medicaid but too little to afford private insurance.

Lack of Awareness

- Many individuals eligible for Medicaid, CHIP, or subsidized plans under the ACA remain uninsured simply because they don’t know about their options.

- A 2024 Urban Institute report found that over 40% of uninsured adults were unaware they qualified for financial assistance or subsidies.

- This lack of awareness prevents many from seeking coverage, even though they may be eligible for free or low-cost options.

Job Instability

- Job instability and the rise of gig and freelance work have contributed to increasing numbers of uninsured workers.

- Many temporary, seasonal, or contract positions don’t offer employer-sponsored health insurance, leaving workers with no coverage.

- Industries like agriculture, construction, and retail often lack employer-provided health benefits, leading to gaps in coverage, especially for those in lower-paying jobs.

- A shift toward nontraditional employment, accelerated by the pandemic, has left many workers vulnerable to periods without insurance.

These issues highlight the complex barriers that prevent individuals from obtaining health coverage, despite available options like Medicaid or ACA plans.

How Can Intermediaries Help People Buy Health Insurance?

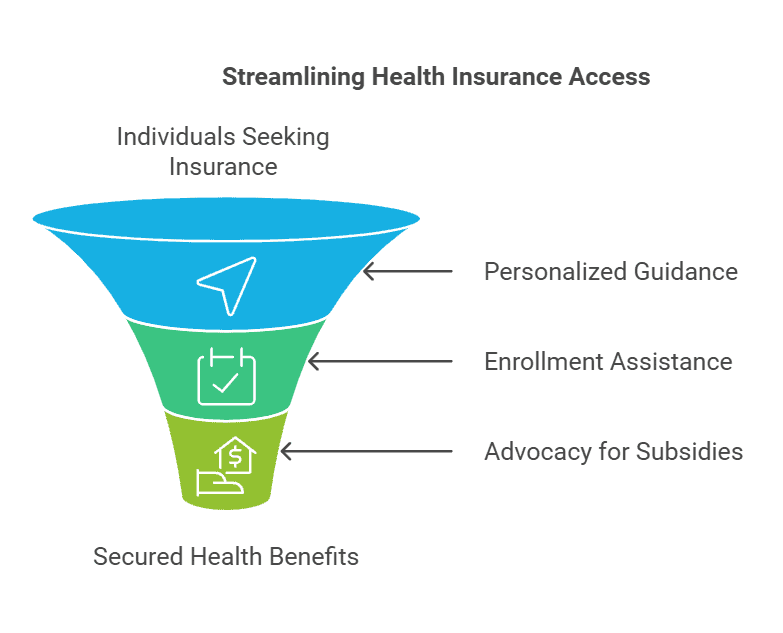

Intermediaries play a vital role in addressing the health coverage gap. These professionals and platforms bridge the knowledge gap, offering tailored solutions to help individuals and families secure the best health benefits.

- Personalized Guidance

Navigating health insurance options can be overwhelming. Intermediaries simplify the process by assessing individual needs, comparing plans, and explaining terms like deductibles, premiums, and out-of-pocket maximums in accessible ways.

- Enrollment Assistance

Many people miss enrollment deadlines for Medicaid, CHIP, or ACA marketplaces. Intermediaries provide timely reminders and facilitate the enrollment process, ensuring no eligible person is left uninsured.

- Advocacy for Subsidies

Understanding eligibility for subsidies can be complex. Intermediaries advocate on behalf of individuals to secure premium tax credits or reduced deductibles, making insurance more affordable.

Conclusion: Simplifying the Process to Buy Health Insurance

Navigating the complexities of health insurance can be daunting, especially for underserved populations like gig workers, rural residents, and immigrants. These groups often face unique challenges that prevent them from accessing affordable and reliable coverage. Tailored solutions and targeted support are essential to bridging this gap, ensuring that everyone has access to essential healthcare services.Intermediaries like PEO4YOU play a vital role in simplifying the process to buy health coverage. Acting as a trusted link between individuals and companies offering health insurance, PEO4YOU helps people identify their eligibility for programs like Medicaid or ACA subsidies and select plans that suit their needs and budget. By connecting clients with the right health insurance and health care solutions, PEO4YOU ensures that health coverage is accessible, affordable, and comprehensive.