Access to health insurance is essential for employees and their families to obtain necessary medical care. For businesses, offering health insurance is not just a legal obligation in many cases but also a strategic investment in employee well-being and company growth. But how do companies behave when it comes to providing health insurance, and why is this important?

This article explores the reasons behind corporate decisions on health insurance, the benefits of offering comprehensive coverage, and how intermediaries like PEO4YOU play a vital role in connecting individuals to the best health care options.

Why Health Insurance is Best for Companies and Employees

1. Meeting Legal Obligations

In the U.S., the Affordable Care Act (ACA) requires businesses with 50 or more full-time employees to offer health insurance or face penalties. Smaller companies are not legally required to provide coverage, but many choose to do so for competitive reasons.

Reported by the U.S. Department of Labor, businesses that comply with ACA requirements not only avoid penalties but also foster employee trust. Companies that fail to provide insurance risk high turnover rates and legal challenges.

- Example: A 2023 report from the Kaiser Family Foundation (KFF) shows that nearly 40% of small businesses with fewer than 50 employees offer health insurance despite not being required to, highlighting its value as a tool for employee retention.

2. Health Insurance as a Recruitment and Retention Tool

Health insurance is best regarded as a critical factor in attracting and retaining top talent. In today’s competitive job market, comprehensive benefits packages, including health insurance, are often the deciding factor for job seekers.

According to the 2023 Employer Health Benefits Survey by the Kaiser Family Foundation, 78% of employees prioritize health insurance when evaluating job offers. Companies that provide robust coverage experience higher employee satisfaction and loyalty.

- Why it Matters: Employees without health coverage are more likely to leave for competitors who offer better benefits. This can lead to increased turnover costs, which can be as high as 33% of an employee’s annual salary, according to SHRM (Society for Human Resource Management).

3. The Financial Implications of Health Insurance

While offering health insurance involves costs, it can also provide significant financial advantages:

- Tax Incentives: Employers can deduct health insurance premiums from their taxes, reducing overall costs.

- Group Rate Savings: Companies often secure lower premiums through group health plans, making coverage more affordable for employees and the organization.

- Reduced Absenteeism: Employees with health coverage are more likely to seek preventive care, reducing long-term medical costs and absenteeism.

A 2023 study published by the Commonwealth Fund found that companies offering comprehensive health benefits saw a significant decrease in employee sick days, directly impacting productivity and operational efficiency.

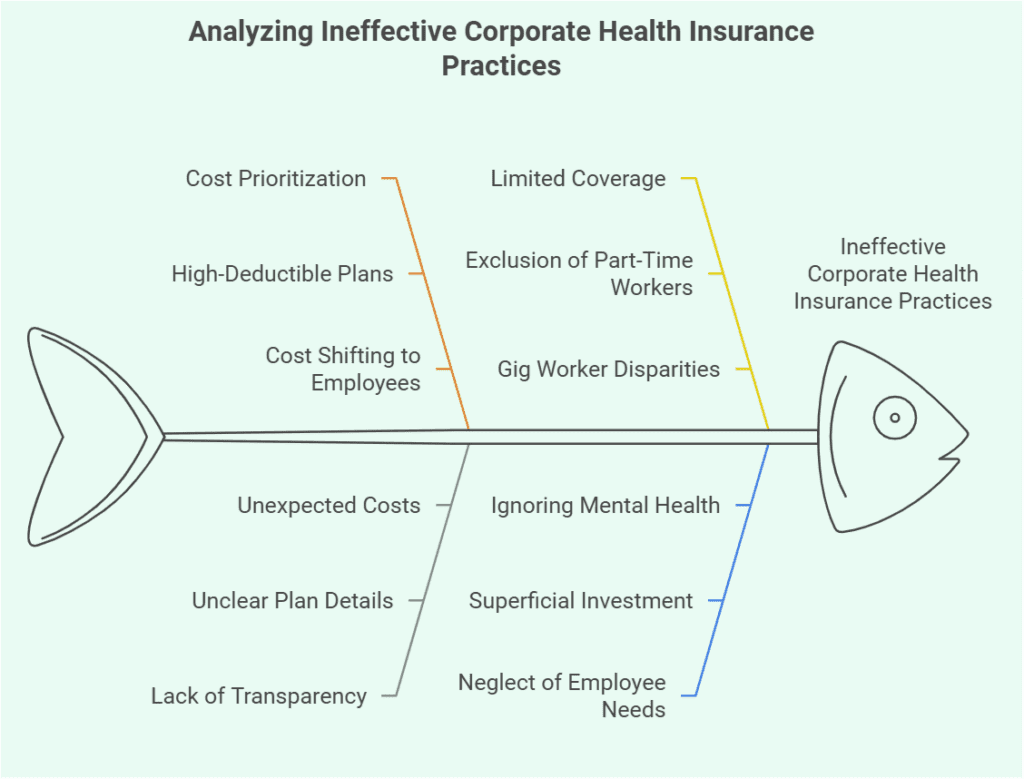

Behaviors Companies Exhibit

1. Cost Prioritization Over Coverage

Many businesses prioritize saving money over offering comprehensive plans. High-deductible health plans (HDHPs) without support like Health Savings Accounts (HSAs) are common, leaving employees with significant out-of-pocket expenses.

2. Lack of Transparency

Some companies fail to clearly communicate plan details, leading to confusion about benefits and unexpected costs.

3. Limited Coverage for Part-Time and Gig Workers

Employers often exclude non-full-time employees from health insurance, creating disparities in access to care for vulnerable groups.

4. Superficial Investment in Health Benefits

Offering basic plans to meet legal requirements without considering employee needs can lead to dissatisfaction and turnover.

5. Shifting Costs to Employees

High premiums and limited employer contributions make coverage unaffordable for many workers, resulting in lower enrollment rates.

6. Ignoring Mental Health and Preventive Care

Excluding mental health services and preventive care undermines employee well-being, leading to long-term costs for both employees and employers.

Challenges Companies Face with Health Insurance

1. Rising Healthcare Costs

Healthcare costs in the U.S. have been steadily increasing. The Centers for Medicare and Medicaid Services (CMS) reported that total healthcare spending reached $4.3 trillion in 2022 with an expected growth of 5%-6% annually. In 2023, employer-sponsored insurance premiums rose by 7%, according to CMS and KFF.

- Impact on Companies: Smaller businesses often struggle to balance offering competitive health benefits with managing costs. Many turn to high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) to control expenses while still offering coverage.

2. Navigating Complex Regulations

Health insurance regulations vary by state, and federal rules like the ACA add layers of complexity. Companies must ensure compliance with coverage mandates, reporting requirements, and nondiscrimination rules.

- Example: Reports by the U.S. Government Accountability Office highlighted that noncompliance with ACA requirements lead to fines in excess of $1 billion every year. In 2015, there were $4.5 billion in penalties and fines.

3. Meeting Diverse Employee Needs

Workforces are increasingly diverse, and one-size-fits-all health plans often fall short. Companies must cater to varying needs, such as:

- Maternity care for young families.

- Chronic condition management for older employees.

- Mental health services for all age groups.

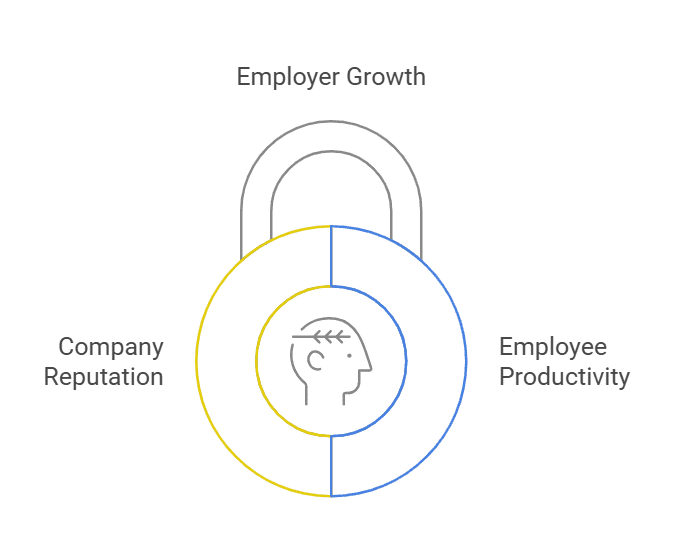

Why Offering Health Insurance is Best for Employer Long-Term Growth

1. Enhanced Employee Productivity

Employees who have access to health insurance are healthier, more engaged, and more productive. Preventive care services, covered under most plans, help employees manage conditions before they become severe.

A study by Health Affairs in 2023 found that companies offering comprehensive health insurance experienced a significant decrease in absenteeism and increase in employee productivity compared to those that did not.

2. Boosting Company Reputation

Organizations known for their employee benefits often attract positive attention. Health insurance is a cornerstone of corporate social responsibility (CSR) initiatives, showing that companies prioritize employee welfare.

- Example: Tech giants like Google and Microsoft are celebrated not only for their innovation but also for their extensive health benefits, including mental health services and wellness programs

Conclusion: Why Health Insurance is Best with PEO4YOU

Health insurance is not just a necessity—it’s a strategic advantage for companies and a lifeline for employees. While businesses face challenges such as rising costs and regulatory complexities, offering health insurance yields significant benefits, from enhanced employee productivity to improved talent retention.By partnering with intermediaries like PEO4YOU, companies and individuals can find the right health insurance options with ease. Whether you’re a business seeking competitive group plans or an individual looking for affordable coverage, PEO4YOU bridges the gap, ensuring that health plans are best tailored to your unique needs.