The short answer is yes, small business health insurance is often cheaper than individual health plans by effectively using tax credits and group risk pooling along with Professional Employer Organizations (PEOs). To understand the full scope, one must analyze both the immediate costs and the extended benefits for employers and employees.

This article explores the reasons behind the lower per-person premiums that small businesses pay compared to individual coverage costs and discusses how strategic choices like working with a PEO can generate savings and boost employee happiness and retention.

Small businesses that offer group health insurance join a system that distributes risk among various employees. By pooling risks across employees group plans enable insurers to minimize their financial exposure and provide lower monthly premiums per participant compared to individual market rates.

Group vs. Individual Premiums: In 2024 individual plan premiums averaged more per person than small group plans with mid-tier Silver plans from ACA and employer-based options showing the highest differences (KFF, 2024).

Employers typically pay between 50% and more of employee premium costs. Employees spend less on premiums when their employers share the cost rather than if they purchased personal insurance by themselves.

PEO4YOU charges individuals $938/month for base premiums but employees pay only $469/month when their employer covers 50% which shows it's cheaper than most ACA Silver or Gold plans without subsidies.

When small businesses provide health insurance they can access tax credits and deductions which remain unavailable for individual policyholders.

A Small Business Group Plan functions as an ACA-compliant individual health insurance option.

Small businesses gain access to large risk pools through Professional Employer Organizations which helps them secure lower insurance rates while reducing administrative work.

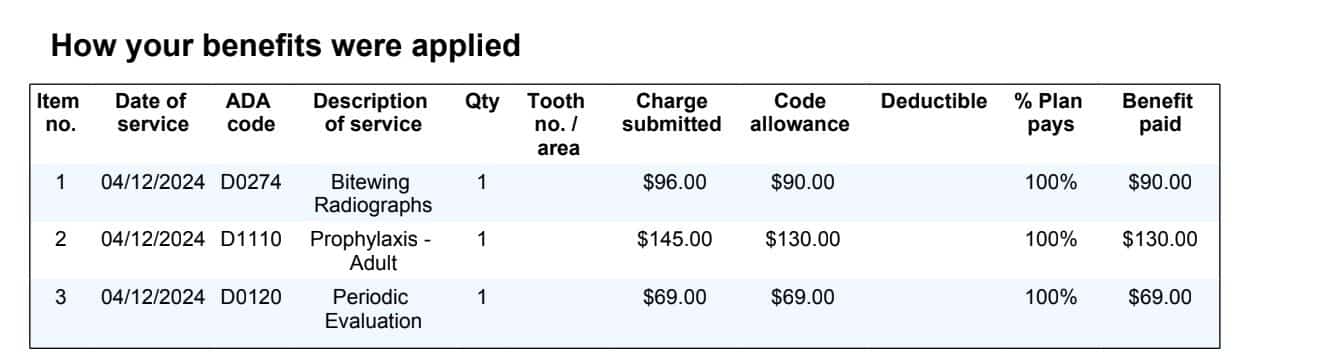

Group health insurance packages which include medical, dental, vision and life insurance begin at:

Self-employed and sole proprietor ACA family plans typically exceed $2,500/month before subsidies while featuring higher deductibles and restricted networks.

An effective benefits package sets you apart from competitors while establishing workforce loyalty.

When employees maintain good health they experience reduced stress levels and improved concentration while taking fewer sick days.

When companies show dedication to their employees' well-being they build teams who are both dedicated and engaged.

Jane runs a boutique in Burlington, VA with 10 employees. She needed to compare Vermont Health Care Insurance to prepare for increasing ACA premiums and unpredictable healthcare participation from her employees. Upon transitioning to PEO4YOU Jane managed to reduce her per-employee premium by 35% while obtaining dental and vision benefits which led to a 20% increase in her employee retention rate in the first year.

The ACA does not require companies with less than 50 full-time employees to provide health coverage. But doing so voluntarily opens access to:

Offering insurance benefits proves to be the most strategic decision for businesses seeking growth even without a legal obligation to do so.

Employees who receive personalized healthcare plans aimed at managing chronic conditions along with mental health support and preventive care maintain better health while exhibiting enhanced productivity.

Encourage your team to:

When employees maintain good health they become more committed and driven at work.

What do employees need from their health insurance plan among lower premiums, more provider options, and additional benefits?

PEO4YOU and similar professional organizations manage compliance requirements while also executing enrollment processes and conducting benefit negotiations.

Present cost-sharing plans that support financial accountability while encouraging preventive healthcare measures.

Yes—especially when done right. Many cases show small business health insurance to be less expensive while offering greater coverage and long-term advantages.

Through partnership with PEO4YOU businesses can access top-tier health benefits at lowered costs while maintaining current payroll operations.

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.