The United States health insurance network functions as a complicated and divided system that creates major obstacles for both government officials and private sector businesses as well as everyday citizens. Healthcare continues to face systemic problems with inefficiency and high expenses alongside unequal access even though there are continuous debates and reform attempts. Small businesses and self-employed individuals along with low-income families experience serious effects because they face difficulties obtaining affordable comprehensive health coverage. This article examines the main obstacles to successful health insurance reform along with its effects on different stakeholders and the outcomes of ignoring these systemic inefficiencies.

Main Challenges Preventing Effective Reforms in the Health Insurance System

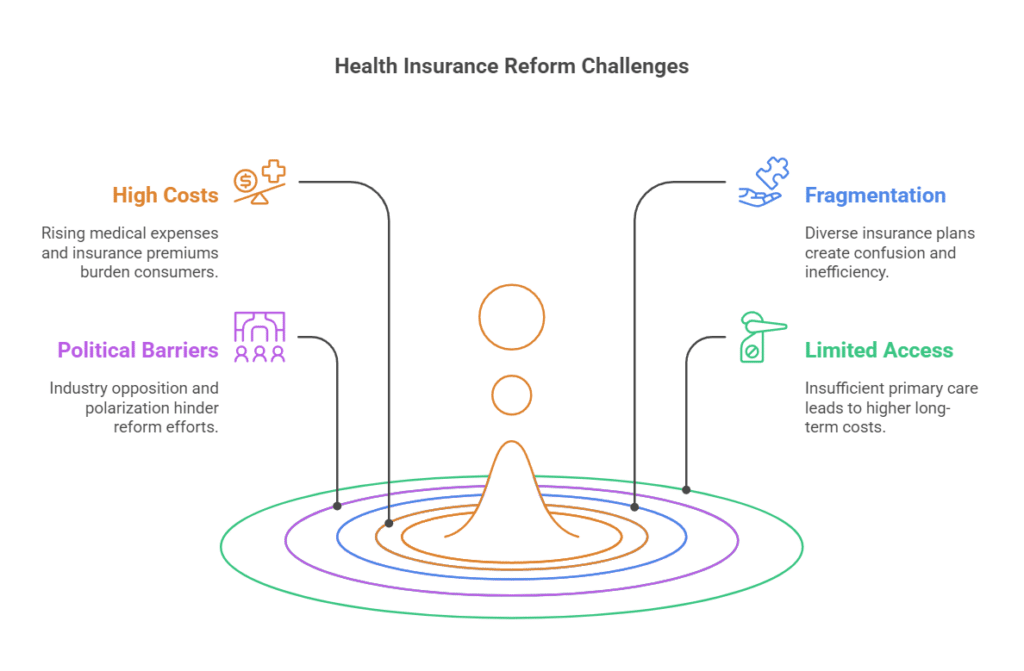

1. High Costs and Affordability Issues

The health insurance system faces significant challenges due to the rapidly increasing expenses for medical services and insurance premiums. Although the United States spends more on healthcare than any other developed country, access to medical services and health outcomes vary widely. According to the Kaiser Family Foundation (KFF) research findings 63% of uninsured adults remain without insurance due to prohibitively high costs. Insurance holders must deal with deductibles and copays that generate substantial financial burdens which make essential medical services unaffordable. A complete overhaul of health insurance policy becomes necessary to alleviate financial burdens faced by patients.

2. Fragmentation and Administrative Complexity

The U.S. healthcare system operates as a complex mix of private insurers and employer-sponsored plans along with Medicaid, Medicare, and marketplace options which creates confusion and leads to inefficiency. The complex task of managing various insurance plans and their respective networks creates administrative burdens which increase healthcare expenses. According to a study published in NEJM Catalyst the United States incurs higher administrative expenses than other wealthy countries because its healthcare system remains fragmented. Health insurance reform presents an opportunity to eliminate these inefficiencies and cut unnecessary expenses.

3. Political and Economic Barriers

Powerful industry groups like private insurance companies along with pharmaceutical firms and healthcare providers stand against changes to the health insurance system. The divisive nature of politics adds layers of complexity to healthcare reform as discussions about government involvement in healthcare create legislative standstills. Healthcare stands as one of the most contentious political issues according to the Gallup Poll because of significant disagreements about how to proceed. Health insurance reform can succeed only if policymakers manage to break down these obstacles while building bipartisan consensus.

4. Limited Access to Primary Healthcare

Healthcare inefficiencies primarily arise from insufficient focus on primary and preventive care services. According to the Pan American Health Organization (PAHO) primary healthcare development plays a vital role in reaching universal health coverage and decreasing future medical expenses. The reform of health insurance systems needs to prioritize improving access to primary care in order to reduce medical expenses over time.

Impact of the Lack of Solutions on Small Businesses, Self-Employed Individuals, and Low-Income Families

- Challenges for Small Businesses

- The financial burden of offering health insurance to employees remains substantial for small businesses.

- Small businesses face increased insurance costs because they lack the economies of scale that benefit large corporations.

- According to a Commonwealth Fund report these challenges continue because numerous small businesses find it difficult to fund complete health plans for their employees.

- The implementation of health insurance reform could reduce these financial burdens since it would offer small businesses more cost-effective group insurance alternatives.

- The Burden on Self-Employed Individuals

- Many self-employed people cannot access employer-sponsored insurance plans so they need to join the individual market that usually presents higher costs.

- The National Center for Biotechnology Information (NCBI) research indicates self-employed people often postpone necessary medical care because of financial worries which leads to higher chances of developing serious health problems.

- Independent workers need health insurance reform to gain access to affordable insurance options.

- The Disproportionate Impact on Low-Income Families

- Families with limited income face higher risks of having inconsistent health insurance protection.

- The ACA’s Medicaid expansion decreased uninsured numbers yet left many low-income people without coverage because of eligibility limitations and unawareness about available programs.

- Because affordable options are unavailable many families skip preventive care which results in poorer long-term health prospects and greater use of emergency health services.

- A strategic overhaul of health insurance systems holds the potential to fill these coverage gaps while increasing access for at-risk groups.

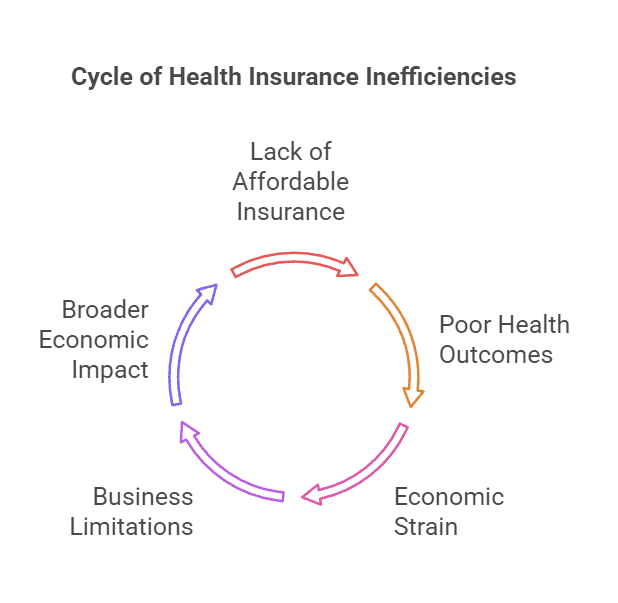

Consequences of Failing to Address Inefficiencies in the Current Health Insurance System

Deteriorating Health Outcomes

Individuals without affordable health insurance options tend to avoid preventive care and delay medical treatment for their conditions. Major health disparities might be reduced through health insurance reform which improves access to preventive care services.

Economic Hardships and Medical Debt

Families and businesses both experience financial strain from expensive healthcare costs. Medical debt remains a primary driver of bankruptcy filings throughout the United States. The JPMorgan Chase Institute report reveals that small businesses providing health benefits face reduced profitability and restricted growth due to rising insurance costs. The economic burden from expensive health care reaches beyond family units by constraining both consumer expenditure and corporate investment throughout the entire economy. To stabilize healthcare costs and protect millions of Americans from financial distress we need health insurance reform.

Navigating Health Insurance Reform: How PEO4YOU Helps Individuals and Businesses Find Affordable Coverage

The health insurance system needs both complete policy reforms and new solutions which offer better access and affordability to address its current challenges. Individuals and businesses need to find appropriate coverage in the current system because systemic changes are essential.

Businesses such as PEO4YOU serve an important function as intermediaries connecting insurance companies with their clients. PEO4YOU helps small businesses and self-employed workers along with families find insurance coverage that balances affordability with comprehensive benefits through their customized health plan solutions. Their knowledge enables clients to select appropriate insurance options that meet their specific requirements while delivering essential assistance through a complex insurance landscape.