Managing medical bills in the United States can be a challenging process. However, with the right knowledge and strategies, individuals can negotiate bills, access hospital financial aid, and leverage health insurance to reduce their financial burden. This guide provides actionable steps and insights for small business owners, independent contractors, and sole proprietors to navigate medical expenses effectively.

An itemized bill is a detailed breakdown of all charges associated with a medical service. It lists every procedure, test, and medication provided, along with their costs. Requesting and reviewing an itemized bill is critical to ensuring accuracy and identifying potential errors.

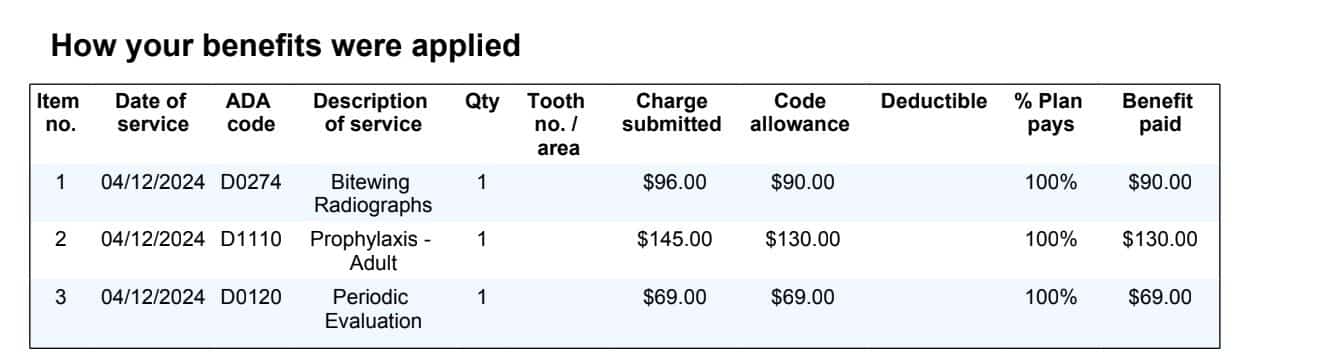

According to data from FairHealthConsumer.org:

These averages serve as benchmarks for evaluating whether the charges on your bill align with standard costs.

The healthcare billing process depends on medical codes as fundamental components. Medical codes serve as the common language that connects healthcare providers, insurance companies and patients to accurately communicate intricate medical service and diagnosis information.

Types of Medical Codes

Why Double-Checking Codes Matters

Always make sure your medical bill contains accurate medical codes. Here’s why:

You do not have to memorize medical codes; however, knowing their purpose and verifying their correctness on your bills will help you avoid unnecessary expenses while improving communication with your healthcare provider.

Hospitals and healthcare providers offer a variety of options to make medical bills more manageable. These include waivers, discounts, and financial plans tailored to patients' financial situations.

Waivers are reductions or eliminations of charges, granted under specific circumstances:

Hospitals frequently provide discounts to reduce costs for eligible patients:

Hospitals often offer payment plans that allow patients to pay their bills over time:

Payment plans offer more than just financial relief. Many patients overlook some key benefits, such as:

Many hospitals offer financial assistance programs to alleviate the burden of high medical bills. These programs are especially beneficial for patients with low income or significant out-of-pocket expenses.

Negotiating medical bills can lead to significant savings. Follow these tips for the best results:

A thorough understanding of your insurance coverage represents an essential phase that must be completed before starting negotiations on medical bills. Here's why:

Before negotiating medical bills it is essential to fully understand the coverage details of your insurance policy. Review your insurance company's website for information on included benefits and expenses you must pay personally. Reviewing your Explanation of Benefits (EOB) provides insight into how your previous claims were processed. You will be able to negotiate from a position of knowledge which gives you a solid foundation.

Taking time to check your insurance coverage enables you to find billing errors that might otherwise lead to unexpected expenses. Reaching out to your insurance company for clarification when you detect discrepancies in your coverage or feel uncertain about coverage details can prevent unnecessary expenses. This measure protects patients from paying extra for services that their insurance should cover.

Interacting with insurance companies requires patience due to extended calls but spending time early can result in substantial reductions to your expenses. Achieving successful negotiations requires you to first understand and confirm your insurance coverage details.

Third-party services exist for people who want to reduce their workload by handling the process for them. These services verify benefits and negotiate costs while managing claims so you get optimal results without enduring extended negotiations.

Checking your insurance coverage helps protect you from overpaying and gives you the information needed to minimize your medical costs.

Medical billing navigation presents challenges yet understanding negotiation techniques enables cost savings. Here’s how to get started:

It's necessary to learn effective negotiation strategies before contacting your healthcare provider or billing department.

In the complex world of medical billing, technology serves as a vital ally in streamlining negotiations. Automated systems and advanced AI tools can significantly simplify the intricate process of negotiating medical bills, allowing medical practices to focus more on patient care.

Automated dialing systems can efficiently interact with insurers to address billing inquiries and disputes. These systems save time by eliminating the lengthy wait times often associated with traditional phone calls. By handling these conversations with precision, these tools ensure that every interaction is consistent and accurate.

AI-driven platforms are revolutionizing how healthcare providers negotiate medical bills. With machine learning capabilities, these tools can analyze vast amounts of billing data, identify discrepancies, and suggest optimal negotiation strategies. This not only enhances accuracy but also empowers staff with actionable insights.

By adopting advanced technologies, healthcare facilities can redirect valuable human resources from administrative tasks to more critical functions, such as direct patient care. This transition from manual to automated processes optimizes efficiency and improves overall patient satisfaction.

Technology eliminates the need for long hold times, a common frustration for both staff and patients. Real-time interactions facilitated by tech solutions make the negotiation process smoother, faster, and more transparent. They also contribute to a more pleasant experience for everyone involved.

So, how can technology impact the negotiation of medical bills? By automating processes, enhancing accuracy, and freeing up staff for more meaningful engagements, technology is not just a tool—it's a transformative force in healthcare billing.

Medical bill negotiation requires calmness because staying composed is essential for success. Remaining composed helps maintain productive conversations beyond just preserving personal calmness. Here's why it's so essential:

In essence, a calm and persistent approach is not just beneficial but fundamentally important in negotiations around medical bills. It maximizes your chances of reaching a favorable resolution, while also preserving your peace of mind.

Hospitals often provide payment options to accommodate different financial needs. Here are the most common structures:

At PEO4YOU, we simplify the complexities of managing medical bills and leveraging health benefits. As an intermediary, we connect individuals and businesses with suitable hospital insurance and financial assistance options.

Managing medical bills in the United States requires a proactive approach, combining negotiation skills, financial assistance, and strategic use of health benefits. From understanding itemized bills to leveraging hospital insurance and payment plans, patients have numerous tools to alleviate financial stress.At PEO4YOU, we are committed to guiding clients through this process. By connecting individuals, families and businesses with tailored healthcare solutions, we ensure access to quality care without compromising financial stability.

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.