What Are Employer Health Plans?

Understanding Employer-Sponsored Health Insurance Plans

Employer health plans are health insurance plans provided by employers to their employees as part of the benefits package. These plans typically cover medical, dental, and vision services, depending on the type of plan offered. Employer-sponsored health plans are generally more affordable for employees compared to individual policies because the employer shares the cost of premiums, making healthcare more accessible.

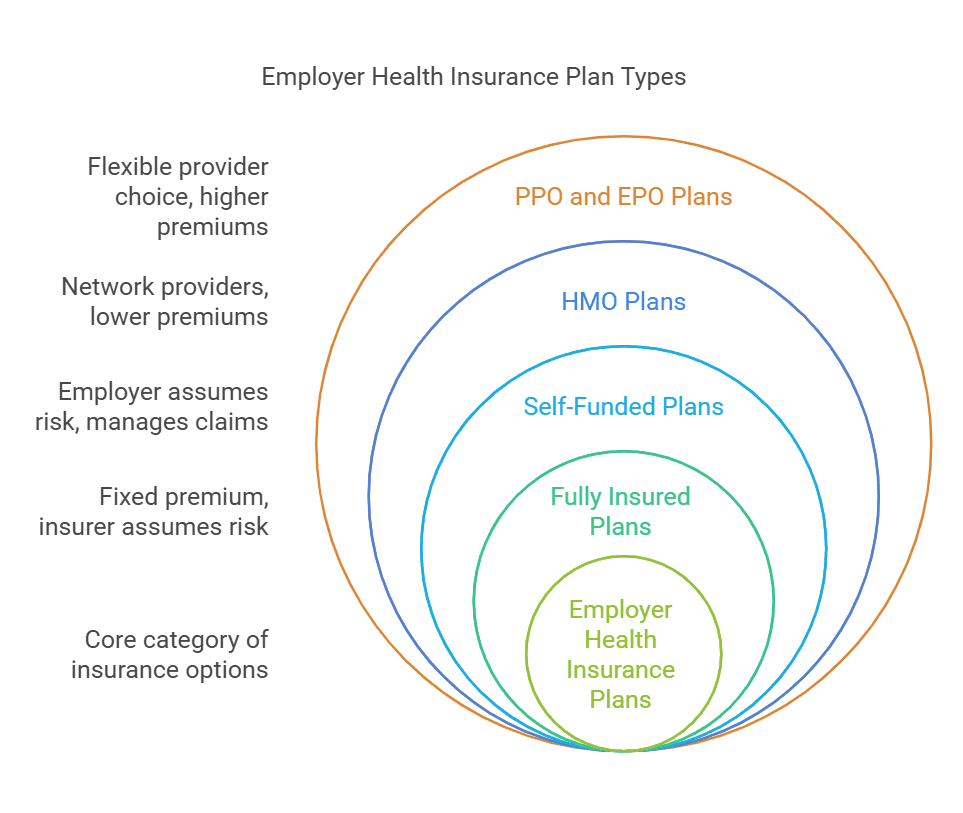

Types of Employer Health Insurance Plans

Employers have several options when selecting a health insurance plan for their workforce. The types of employer health insurance plans include:

- Fully Insured Plans: In this model, the employer pays a fixed premium to an insurance company, which assumes the financial risk of providing healthcare coverage.

- Self-Funded Employer Health Plans: Here, the employer takes on the risk of covering medical expenses rather than paying premiums to an insurance carrier. Employers often work with third-party administrators to manage claims.

- Health Maintenance Organization (HMO) Plans: Employees must use a network of healthcare providers. HMOs usually have lower premiums but are less flexible.

- Preferred Provider Organization (PPO) Plans: Employees can visit any healthcare provider, but they receive better rates by using providers in the network. PPOs are more flexible but generally have higher premiums.

- Exclusive Provider Organization (EPO) Plans: Similar to HMOs but do not require a referral to see specialists, while still limiting coverage to network providers.

- Point of Service (POS) Plans: These plans are a hybrid of HMO and PPO models. They allow more flexibility in choosing healthcare providers but still require referrals for specialists.

Why Employer Health Insurance Plans Are Beneficial

Employer-Sponsored Health Plans vs. Individual Policies

Why are employer health insurance plans often better than individual policies? Employer health plans generally have lower premiums and better coverage options due to the shared cost between the employer and employee. Additionally, employers can negotiate better group rates, offering comprehensive healthcare coverage that is more affordable compared to individual market plans.

Employer health insurance plans also typically offer tax advantages to both employers and employees. Employers can deduct health insurance premiums as a business expense, while employees often pay their share of premiums with pre-tax dollars, reducing their taxable income.

Benefits of Employer Health Plans for Small Businesses

Offering a competitive employer health insurance plan helps small businesses attract and retain top talent. It shows that the employer cares about their employees’ well-being, fostering a sense of loyalty and job satisfaction. Moreover, studies indicate that companies with good health benefits often experience increased productivity and reduced absenteeism.

According to the Kaiser Family Foundation (KFF) Employer Health Benefits Survey, around 56% of small firms (those with 3-199 employees) offer health benefits to at least some of their workers. Providing health insurance makes a company more attractive to potential hires, especially in competitive job markets.

Key Components of Employer Health Insurance Plans

Coverage Options

When choosing employer health care plans, it’s important to understand the different coverage options available, such as:

- Medical Coverage: Covers visits to healthcare providers, hospital stays, preventive care, and prescription drugs.

- Dental and Vision Coverage: Many employer plans include optional dental and vision benefits, which cover check-ups, cleanings, eyewear, and more.

- Mental Health Services: Most employer health plans provide some level of mental health support, including access to counseling and therapy services.

Cost of Employee Benefits to Employer

How much do benefits cost an employer? The cost of providing health insurance varies significantly based on the size of the company, the type of plan, and how much the employer contributes. On average, employers pay about 70-80% of the premiums for employee-only coverage and 50-60% for family coverage. According to the KFF 2024 Employer Health Benefits Survey, the average annual premium was $8,951 for single coverage and $25,572 for family coverage.

Employer Self-Insured Health Plans

Some employers opt for self-funded employer health plans where they take on the financial risk of providing health benefits. Self-insured plans are more common in larger companies, but small businesses can also benefit if they have a healthy workforce and can manage the financial risk.

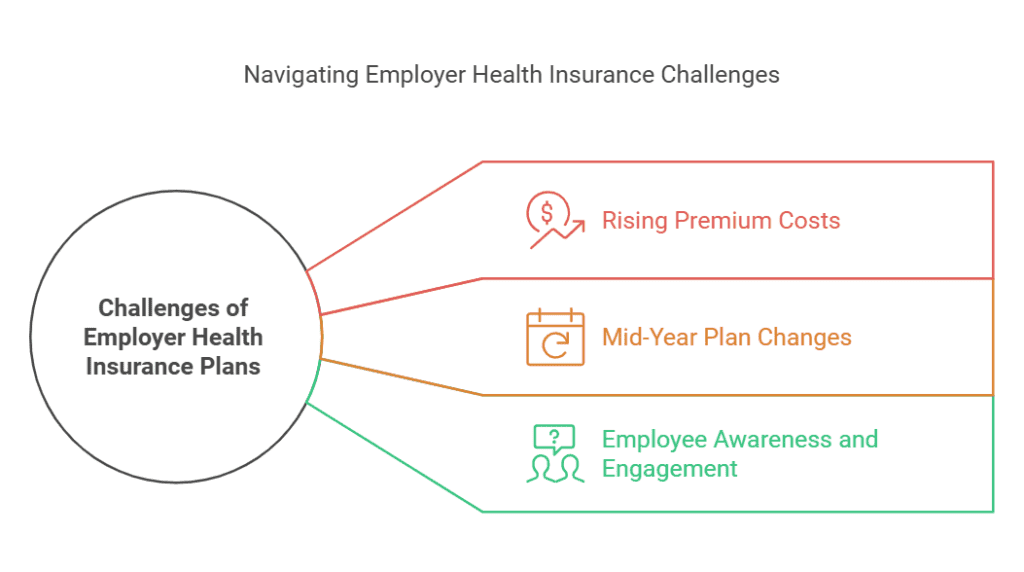

Common Challenges of Employer Health Insurance Plans

Rising Premium Costs

A significant challenge for small businesses is the rising cost of healthcare premiums. According to the KFF Employer Health Benefits Survey, premiums have increased by approximately 22% over the past five years (2021-2025 preliminary 5-year increase data appear to be around 30%). This makes it difficult for small businesses to offer competitive benefits without straining their budgets.

Can an Employer Change Health Plans Mid-Year?

Can an employer change health plans mid-year? Generally, employers can change insurance carriers any time throughout the year. In practice, employers tend to change at the existing plan’s renewal. If changing mid-year, the employer should comply with IRS Section 125 regulations and communicate clearly with employees.

Employee Awareness and Engagement

Employees may not fully understand the details of their health insurance plans, which can lead to confusion and underutilization of benefits. Employers should provide clear communication and resources to help employees make informed decisions about their healthcare.

Which Is Usually True of Employer-Sponsored Health Insurance Plans?

Employer-sponsored health insurance plans typically have several consistent features:

- Shared Costs: Employers pay a portion of the premiums, which makes coverage more affordable for employees.

- Guaranteed Issue: Employees are not denied coverage due to pre-existing conditions.

- Open Enrollment Periods: Employers offer specific periods during the year for employees to enroll, drop, or make changes to their health plans.

The Best Employer Health Insurance Plans

How to Compare Employer Health Insurance Plans

When selecting the best employer health insurance plans, consider factors such as:

- Network Size: Does the plan offer access to a wide network of healthcare providers?

- Premium Costs: How much will both the employer and employee pay?

- Out-of-Pocket Costs: Deductibles, copays, and coinsurance should be evaluated to ensure affordability.

- Flexibility: Are there options to customize the plan according to employee needs?

Employer Health Plans for Small Businesses

Small businesses should consider small employer health plans that provide adequate coverage while remaining budget-friendly. Many insurers offer specific plans designed for small businesses with fewer than 50 employees, which can include tax incentives and streamlined administrative processes.

Self-Funded Employer Health Plans: Pros and Cons

Advantages of Self-Funded Plans

- Cost Savings: Employers can save money if employees have lower-than-expected healthcare costs.

- Plan Customization: Employers have more flexibility in designing a plan that suits the needs of their workforce.

Disadvantages of Self-Funded Plans

- Financial Risk: Employers assume all the risk for claims, which can be costly in years with high medical expenses.

- Complex Administration: Self-funded plans require more involvement in managing claims and compliance, often necessitating a third-party administrator (TPA).

Level funded plans provide a good alternative to self-funded plans by guaranteeing all medical claims are covered. However, the level funded plan is not guaranteed to continue to be offered at renewal if medical claims are too high.

PEO4YOU: A Unique Healthcare Solution

How PEO4YOU Compares

PEO4YOU stands out from traditional Professional Employer Organizations (PEOs) because it does not require changes in payroll and workers’ compensation insurance or medical underwriting with rates not reliant on age or family size, unlike most other PEOs.

Additionally, PEO4YOU offers access to the Blue Cross Blue Shield (BCBS) PPO network, the largest provider network in the U.S., with an estimated 1.7 million providers and over 200,000 mental health practitioners. This extensive network ensures that employees have access to quality care nationwide.

Case Studies and Real-World Applications

Small Business Choosing Employer Health Insurance Plans

Consider a small marketing agency with 20 employees. The owner decides to offer an employer-sponsored health insurance plan to attract top talent and reduce turnover. After comparing options, the agency chooses a PPO plan that offers flexibility for employees who prefer choosing their healthcare providers. The business shares 75% of the premium costs, making it an attractive offer for employees.

Small Business Choosing PEO4YOU

Another example involves a small IT consulting firm with 15 employees, including several families and a higher average employee age. The company initially considered a traditional PEO, but the rates were significantly higher due to the family-heavy demographic and age factors. By switching to PEO4YOU, the business was able to secure competitive rates and provide comprehensive benefits through the BCBS PPO network. The company also benefited from the predictable renewal rates, which were not dependent on its own claims history, making budgeting for healthcare costs more manageable.

Conclusion

Employer health plans play a crucial role in employee satisfaction and retention, making them an essential consideration for small businesses, independent contractors, and sole proprietors. By understanding the various types of employer health insurance plans, evaluating costs, and comparing options, business owners can make informed decisions that benefit both their employees and their bottom line.

Providing health insurance not only makes your company more competitive but also fosters a healthier, more productive workforce. Whether opting for a fully insured plan, a self-funded employer health plan, or exploring small employer health plans, the key is to find a balance between comprehensive coverage and affordability.

If you’re considering offering health insurance or reassessing your current plan, start by evaluating the needs of your workforce and seeking professional guidance to select the best plan that fits your budget.