What Are Employer Benefits?

Understanding Employer Benefits and Their Significance

Employer benefits are non-wage compensations provided to employees in addition to their salaries or wages. These benefits are designed to support employee well-being, promote loyalty, and enhance productivity. The benefits a worker receives from an employer typically include health insurance, paid time off, retirement plans, and other financial incentives. Employer benefits are important because they help employees maintain a work-life balance and give them peace of mind, making it easier for them to focus on their work.

Why Employer Benefits Matter for Small Businesses

For small businesses, offering a comprehensive employer benefits package can significantly enhance employee satisfaction and retention. A strong benefits package allows small companies to compete with larger corporations when hiring talent, as employees are more likely to choose an employer that provides security and support beyond a paycheck. According to a Kaiser Family Foundation (KFF) employer health benefits survey, approximately 56% of small business owners offer health benefits to their employees, demonstrating the importance of employer-provided benefits in the modern workforce.

Key Components of an Employer Benefits Package

The Benefits a Worker Receives from an Employer Typically Include:

According to the 2024 MetLife Employee Benefit Trends Study, the national average percentages for employees who consider each benefit to be a must-have versus not necessary are as follows with the most valued employee benefits:

- Health Insurance: Health insurance is often one of the most desired employer benefits. Employer health benefits can include medical, dental, and vision coverage, helping employees maintain their overall health. The cost of employer-sponsored health insurance benefits varies depending on the level of coverage and whether the employer pays the full premium or shares the cost with employees.

- 78% of employees consider health insurance a must-have, while only 6% consider it not needed.

- Paid Time Off (PTO): PTO includes vacation days, personal days, and sick leave. Providing paid time off ensures that employees can rest and recharge, reducing burnout and increasing productivity.

- 74% of employees consider PTO a must-have, while 6% consider it not necessary.

- Retirement Plans: Employer-paid benefits can also include contributions to retirement plans like 401(k) or pension plans. These contributions are often matched by the employer, providing employees with a financial incentive to save for their future.

- 73% of employees consider retirement plans a must-have, while 6% consider them not necessary.

- Life and Disability Insurance: Some employers offer employer-paid benefits on paycheck deductions for life and disability insurance. These coverages help employees protect themselves and their families in case of unexpected events.

- 62% and 56% of employees consider life and disability insurance as must-haves, while 10% and 12% consider them not necessary, respectively.

- Fringe Benefits: Nontaxable fringe benefits, such as gym memberships, childcare assistance, or commuter subsidies, are attractive to both the employer and the employees. These perks can improve employee morale and create a more engaged workforce.

- According to Forma, lifestyle spending accounts tend to be valued as highly as 401ks.

Employer Health Benefits and Cost Considerations

The cost of employee benefits to the employer can be substantial, but they also have a significant positive impact on employee satisfaction and loyalty. The total cost typically depends on several factors, such as the size of the company, the benefits offered, and the coverage level. For instance, health insurance is often one of the most expensive benefits that employers provide, but it is also the most valued by employees.

A plan in which an employer pays insurance benefits from a fund derived from company contributions is called a self-insured or self-funded plan. In this setup, the employer takes on the responsibility of covering employee healthcare costs, which can be more cost-effective for larger organizations with predictable healthcare expenses.

With 80% of the workforce will choose a job that offers benefits over a job that offers 30% more salary but no benefits, offering benefits tends to be beneficial for employers. This is because most of the time benefits cost less than this 30% of employee salaries. In addition, benefits have tax advantages for employers compared to paying wages and salaries. In this way, providing employee benefits is generally provides employers with a positive ROI compared to not offering benefits. But is this a surprise when all Fortune 500 companies provide killer benefit packages when they are designed to be profit-maximizing machines?

Employer-Paid Benefits on Paycheck and Their Importance

What Are Employer-Paid Benefits on a Pay Stub?

When reviewing their pay stub, employees may notice deductions labeled as employer-paid benefits. These deductions include employer contributions to health insurance, retirement plans, and other benefits. Understanding these deductions helps employees appreciate the value of the benefits provided by their employer and how much they are saving by being part of the company’s plan.

What Does 100% Employer-Paid Benefits Mean?

100% employer-paid benefits mean that the employer covers the entire cost of the benefit, without requiring any contribution from the employee. This type of benefit is highly valued because it saves employees money and increases the attractiveness of the employer’s compensation package. Examples of 100% employer-paid benefits can include life insurance, disability coverage, and even full health insurance premiums in some cases.

Who Benefits More from Being Paid in Cash: Employer or Employee?

Cash payments, while simple, have both advantages and disadvantages for employers and employees. On one hand, paying in cash might seem like a straightforward method of compensation. However, providing comprehensive benefits is often more advantageous for both parties in the long run.

Employer vs. Employee: The Benefits of Cash Payments

- Employer Perspective: Employers may benefit from cash payments by reducing administrative costs and avoiding the complexities of managing benefit plans. However, they may struggle to retain top talent without offering a benefits package.

- Employee Perspective: Employees may appreciate the immediacy of cash payments, but they lose out on the long-term value that benefits provide. For instance, health insurance, retirement contributions, and paid time off are benefits that provide significant value beyond an employee’s monthly salary.

Why Are Nontaxable Fringe Benefits Attractive to Both the Employer and Employees?

Nontaxable fringe benefits are highly attractive because they offer financial advantages to both employers and employees. Since these benefits are not subject to federal income tax, Social Security, or Medicare taxes, they effectively reduce the overall taxable income of the employee, resulting in cost savings for both parties. Examples include tuition assistance, company-provided vehicles for business use, and dependent care assistance.

Employer Benefits Consulting: How to Create an Attractive Benefits Package

The Role of Employer Benefits Consulting

Employer benefits consulting involves working with benefits experts to design an optimal benefits package that aligns with the company’s goals and budget. Small businesses often benefit from consulting services because consultants help them evaluate different options, negotiate better rates, and ensure compliance with labor laws.

Factors to Consider When Creating an Employer Benefits Package

- Employee Needs and Preferences: Conducting employee surveys can help identify the benefits that matter most to your workforce. Health insurance, retirement savings, and paid time off are generally the most popular.

- Budget Constraints: Determine how much your business can afford to spend on employee benefits without jeopardizing financial stability.

- Legal Requirements: Ensure compliance with federal and state laws regarding employee benefits. For instance, the Affordable Care Act (ACA) requires employers with 50 or more full-time employees to provide health insurance.

How Much Do Benefits Cost an Employer?

Calculating the Cost of Employee Benefits to the Employer

The cost of employee benefits to an employer typically ranges from 20% to 30% of an employee’s base salary. For example, if an employee earns $50,000 annually, their benefits could cost the employer an additional $10,000 to $15,000 per year. Factors that affect these costs include the number of employees, the types of benefits offered, and whether the company shares costs with employees.

KFF Employer Health Benefits Survey Insights

The KFF employer health benefits survey indicates that the average annual premium for employer-sponsored family health coverage is around $22,000, with employers covering about 70% of that cost. These statistics highlight the significant financial commitment involved in providing health benefits but also show how valuable these benefits are to employees.

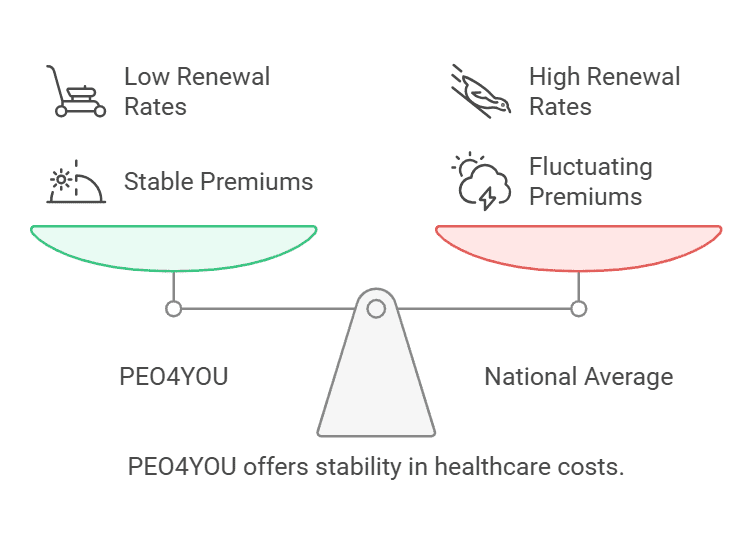

Stability and Benefits of PEO4YOU

PEO4YOU provides a unique solution for small business owners by offering stable premiums regardless of employee age or health. Unlike many marketplace plans, where premiums can vary significantly based on these factors, PEO4YOU keeps the costs consistent for all participants. This is particularly beneficial for businesses with a diverse workforce, as it simplifies budgeting and ensures predictability.

PEO4YOU’s monthly costs are structured as follows:

- Individuals: $938 per month

- Couples (Employee + Spouse): $1,884 per month

- Employee + Child(ren): $1,530 per month

- Families: $2,093 per month

- Waived Employees: $32 per month

These fixed costs ensure that small businesses can offer competitive health benefits without the uncertainty of fluctuating premiums based on age or health status.

Additionally, PEO4YOU offers steady renewal rates, with average increases of under 16% over the last five years. In comparison, the national average for health insurance premium increases over the same period is around 40%. This stability is a major advantage for small businesses that want to avoid sudden spikes in their healthcare expenses.

PEO4YOU also provides access to the largest provider network in the country through the Blue Cross Blue Shield (BCBS) PPO network. This extensive network includes an estimated 1.7 million healthcare providers, along with over 200,000 mental health practitioners. The breadth of the BCBS PPO network ensures that employees have access to high-quality healthcare professionals across the nation, offering both convenience and flexibility in choosing providers.

In addition to medical coverage, PEO4YOU includes dental, vision, and life insurance benefits as part of their bundled offering:

- Dental Coverage: The maximum benefit is $2,000 per calendar year while covering all standard procedures including implants which many dental plans exclude.

- Vision Coverage: Vision benefits include a $10 copay for exams every 12 months, a $25 copay for single lenses, and coverage of up to $250 for frames every 24 months or contacts every 12 months.

- Life Insurance: A $10,000 death benefit is provided per covered employee, ensuring financial support for families in the event of an unexpected loss.

These features make PEO4YOU an attractive option for small business owners seeking comprehensive coverage for their employees without the volatility often associated with the health insurance market.

Conclusion

Offering a comprehensive employer benefits package is essential for small business owners, independent contractors, and sole proprietors looking to attract and retain top talent. Employer-paid benefits, such as health insurance, retirement plans, and nontaxable fringe benefits, provide security and value to employees while enhancing their loyalty and satisfaction. Understanding the costs, benefits, and strategies for creating an effective benefits package will help small businesses stay competitive in today’s job market.

If you are a small business owner, consider working with employer benefits consulting experts to create a package that meets your employees’ needs and supports your business’s growth. Investing in a well-rounded benefits package is not just about meeting legal obligations—it’s about building a strong, dedicated workforce that feels valued.