Receiving a medical bill despite having health insurance can be frustrating and confusing. Many policyholders assume that their healthcare insurance coverage will cover all medical expenses, but there are several reasons why you might still receive a bill. Here’s a closer look at some of the most common scenarios and what you can do:

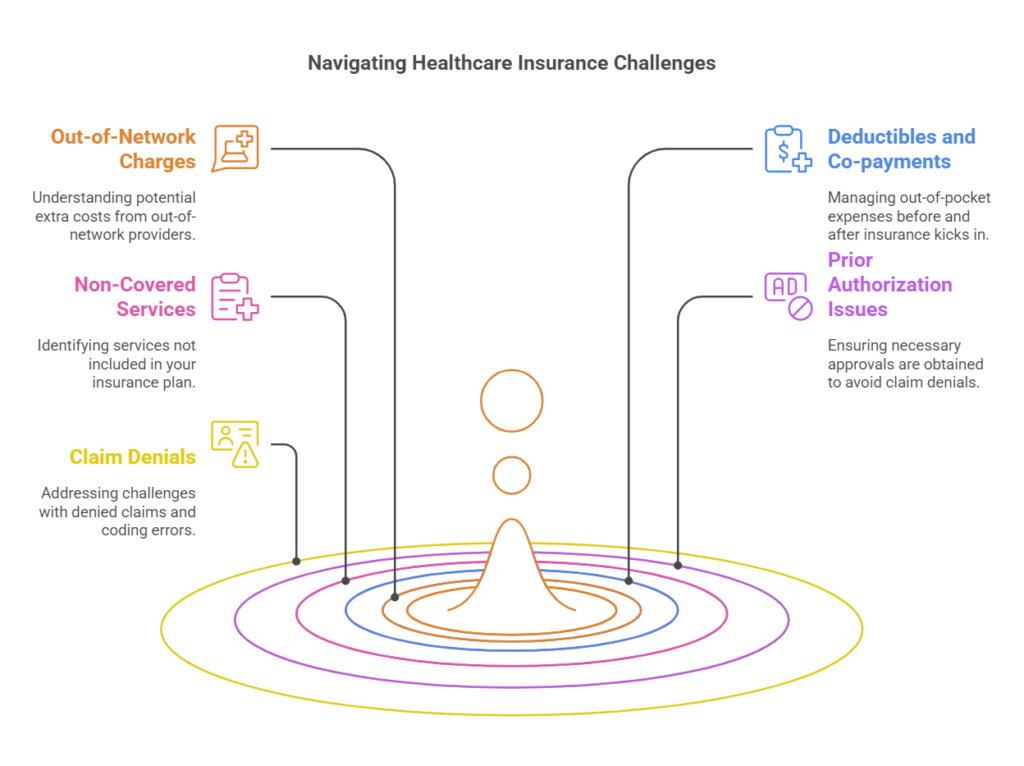

Out-of-Network Providers

Even if you visit an in-network hospital or clinic, certain specialists (such as anesthesiologists, radiologists, or emergency room physicians) may be out of network. If this happens, your healthcare insurance coverage may only cover part of their charges, leaving you responsible for the balance. This is known as balance billing, where the provider bills you for the difference between what they charged and what the insurance covered.

Example: You go to an in-network hospital for surgery, but the anesthesiologist handling your procedure is out of network. Your healthcare insurance coverage covers a portion of the cost, but you receive a separate bill for the remaining balance.

Solution: The No Surprises Act protects you from certain types of out-of-network charges, but always verify provider network status before receiving non-emergency treatment.

Insurance Deductibles and Co-payments

Your healthcare insurance coverage likely includes a deductible, which is the amount you must pay out of pocket before insurance coverage begins. Additionally, many plans have co-payments or coinsurance, requiring you to pay a percentage of medical costs even after the deductible is met.

Example: Your healthcare insurance coverage has a $1,500 deductible. If your medical bill is $2,000 and you haven’t yet met your deductible for the year, you’ll be responsible for the first $1,500, and your insurance will cover the remaining amount based on your plan’s coverage rules.

Solution: Review your healthcare insurance coverage documents to understand your deductible, copayments, and out-of-pocket maximums.

Services Not Covered by Your Insurance

Not all medical services are covered under every insurance plan. Certain procedures, treatments, or medications may be excluded or require prior authorization.

Example: Some healthcare insurance coverage does not cover alternative treatments like acupuncture or fertility treatments such as in-vitro fertilization (IVF). If you receive these services, you may be responsible for the entire cost.

Solution: Before undergoing a procedure, confirm with your insurer whether it is covered under your healthcare insurance coverage.

Prior Authorization Was Not Obtained

Many healthcare insurance coverage plans require pre-authorization before covering specific treatments, procedures, or specialist visits. If your provider didn’t obtain approval in advance, your insurance might deny the claim.

Example: You receive an MRI for a non-emergency condition, but your doctor didn’t get prior approval from your insurance company. Your healthcare insurance coverage denies the claim, leaving you with the full bill.

Solution: Before scheduling procedures, check whether prior authorization is needed and confirm that it has been obtained.

Claim Denial or Coding Errors.

Insurance companies sometimes deny claims due to administrative errors, incorrect billing codes, or insufficient documentation from the healthcare provider.

Example: A routine lab test is mistakenly coded as a more expensive test, causing your healthcare insurance coverage to deny coverage.

Solution: Always request an itemized bill, compare it with your Explanation of Benefits (EOB), and appeal denied claims when necessary.

Who Is Responsible for Medical Bills Not Covered by Insurance?

When medical bills are not fully covered by healthcare insurance coverage, the responsibility for payment falls on different parties depending on the circumstances. Below is a breakdown of who may be responsible and what steps you can take to manage the costs.

The Patient – Primary Responsibility

As the policyholder, you are ultimately responsible for any portion of a medical bill that your healthcare insurance coverage does not cover. This includes:

- Deductibles – The amount you must pay before your insurance starts covering costs.

- Co-payments – A fixed fee you pay for certain services (e.g., $25 for a doctor’s visit).

- Coinsurance – The percentage of costs you must share with insurance (e.g., 20% of a hospital bill).

- Non-Covered Services – Treatments or procedures your healthcare insurance coverage does not cover at all.

What You Can Do:

- Review your Explanation of Benefits (EOB) to ensure accuracy.

- Contact your healthcare provider to confirm charges and request an itemized bill.

- If necessary, ask about payment plans or financial assistance programs.

The Healthcare Provider – Willing to Negotiate

Hospitals, doctors, and medical facilities can sometimes reduce bills or offer payment plans. Many providers have financial assistance programs for patients who cannot afford their bills.

What You Can Do:

- Call the billing department and ask about financial aid or a discount for paying in full.

- Request a payment plan to spread the cost over time.

- Negotiate a lower price—especially if you’re uninsured or paying out of pocket.

Your Employer (If You Have Employer-Sponsored Insurance)

If you receive healthcare insurance coverage through your job, your employer might assist in clarifying coverage details, resolving disputes, or providing additional benefits. Some employers offer health reimbursement arrangements (HRAs) to help employees cover out-of-pocket costs.

What You Can Do:

- Speak with your HR or benefits department about denied claims.

- Check if your employer offers an HRA, HSA, or FSA (tax-advantaged accounts for medical expenses).

The Insurance Company – Can Reverse Denied Claims

Sometimes, insurance companies deny claims due to coding errors, missing paperwork, or incorrect eligibility determinations. Many denied claims are successfully appealed.

What You Can Do:

- File an appeal if you believe the denial was incorrect.

- Request a review of the claim and provide any additional documentation.

- If your appeal is denied, contact your state’s insurance commissioner for assistance.

Government Assistance & Non-Profit Organizations

If you are unable to pay a medical bill, you may qualify for government programs like Medicaid, hospital charity programs, or nonprofit financial assistance.

What You Can Do:

- Check if your hospital has a charity care program.

- Look into state and federal aid programs such as Medicaid.

- Seek help from non-profits that assist with medical debt relief.

Final Thoughts

If you receive a medical bill that is not covered by your healthcare insurance, don’t ignore it—you have options. Review your bill carefully, negotiate where possible, and explore employer, government, and non-profit assistance programs.

“Mastering Medical Bills: Navigate Insurance Like a Pro”

Understanding why you receive a medical bill despite having insurance coverage is crucial for avoiding unnecessary expenses. By knowing your healthcare insurance coverage details, checking for billing errors, and exploring payment assistance options, you can better manage medical costs. For small businesses and individuals looking for affordable healthcare insurance coverage, PEO4YOU acts to help clients find the best health coverage solutions. Their expertise in navigating employer-based and individual health plans ensures that businesses and employees receive the coverage they need without the burden of surprise medical bills. Whether you’re a small business owner providing health benefits or an individual seeking comprehensive plans, PEO4YOU can help streamline the process and connect you with the right healthcare insurance options.