Access to hospital services is one of the most critical aspects of health insurance coverage. A well-structured medical plan ensures that individuals and families can receive essential hospital care without facing crippling financial burdens. This article explores how health insurance covers hospital services, the types of plans offering the most comprehensive coverage, challenges faced by hospitals, and how health insurance plays a role in addressing those challenges.

Intermediaries like PEO4YOU simplify the process of finding the right medical plan by connecting individuals and businesses with the best health care options tailored to their needs.

Why Hospital Services Matter in a Medical Plan

Hospital services encompass a wide range of care, including emergency room visits, inpatient care, surgeries, maternity services, and specialized treatments. According to a 2024 report by the American Hospital Association (AHA), hospital care accounted for nearly 30% of all U.S. healthcare expenditures, highlighting its importance in health coverage.

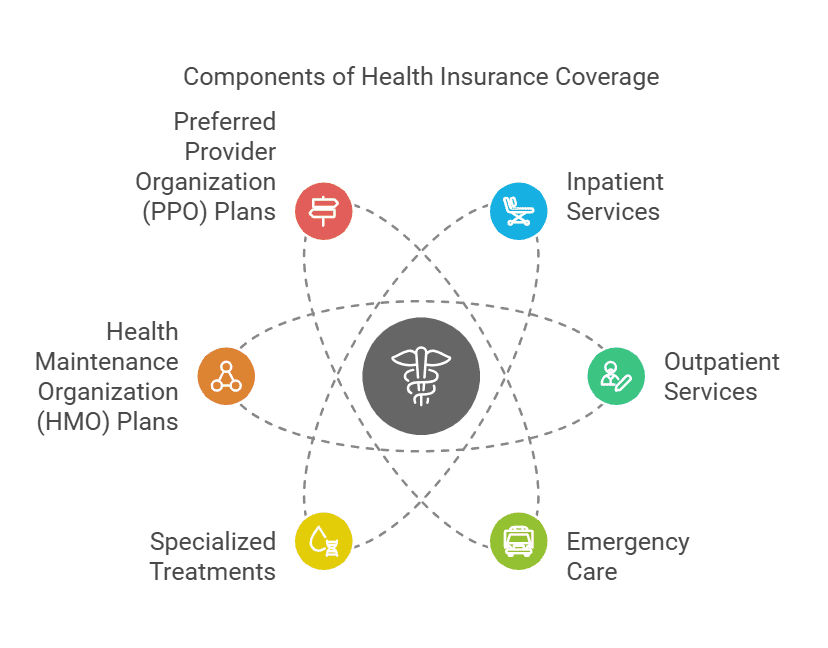

A good medical plan ensures access to:

1. Inpatient Services

Inpatient care refers to medical treatments provided when a patient is admitted to a hospital for at least one night. This includes services like:

- Surgeries: Procedures that require pre- and post-operative care, such as joint replacements, heart surgeries, or cesarean deliveries.

- Critical Care: Intensive monitoring and treatment for patients in units like the Intensive Care Unit (ICU).

- Hospital Stays: Services provided during extended stays, including room charges, nursing care, medications, and meals.

Why it Matters: Inpatient care often involves significant costs, making it essential for a medical plan to offer comprehensive coverage to reduce financial strain.

2. Outpatient Services

Outpatient care involves medical procedures or consultations that do not require an overnight stay in a hospital. These include:

- Diagnostic Tests: Imaging like X-rays, MRIs, or CT scans to identify medical conditions.

- Minor Procedures: Treatments such as mole removals, colonoscopies, or joint injections that can be completed within a few hours.

- Rehabilitation Services: Physical therapy or occupational therapy sessions conducted on an outpatient basis.

Why it Matters: Outpatient care is often more cost-effective than inpatient services, and most modern medical plans offer extensive coverage for these services to promote preventive care and early treatment.

3. Emergency Care

Emergency care addresses urgent medical conditions that require immediate attention to prevent severe health outcomes. Common scenarios include:

- Trauma Care: Treatment for injuries sustained from accidents or falls.

- Acute Conditions: Severe illnesses such as strokes, heart attacks, or appendicitis.

- Ambulance Services: Transportation to the nearest emergency facility.

Why it Matters: Under the Affordable Care Act (ACA), medical plans are required to cover emergency services without preauthorization, even if the hospital is out-of-network.

4. Specialized Treatments

Specialized care focuses on advanced or complex medical conditions requiring unique expertise or technology. Examples include:

- Cancer Care: Treatments like chemotherapy, radiation therapy, or immunotherapy.

- Organ Transplants: Comprehensive services from donor matching to post-transplant care.

- Chronic Condition Management: Advanced therapies for conditions such as Parkinson’s disease or multiple sclerosis.

Why it Matters: Specialized treatments often come with high costs, but they are crucial for patients managing life-threatening or long-term illnesses. Comprehensive medical plans ensure these services are accessible and affordable.

How Health Insurance Covers Hospital Services

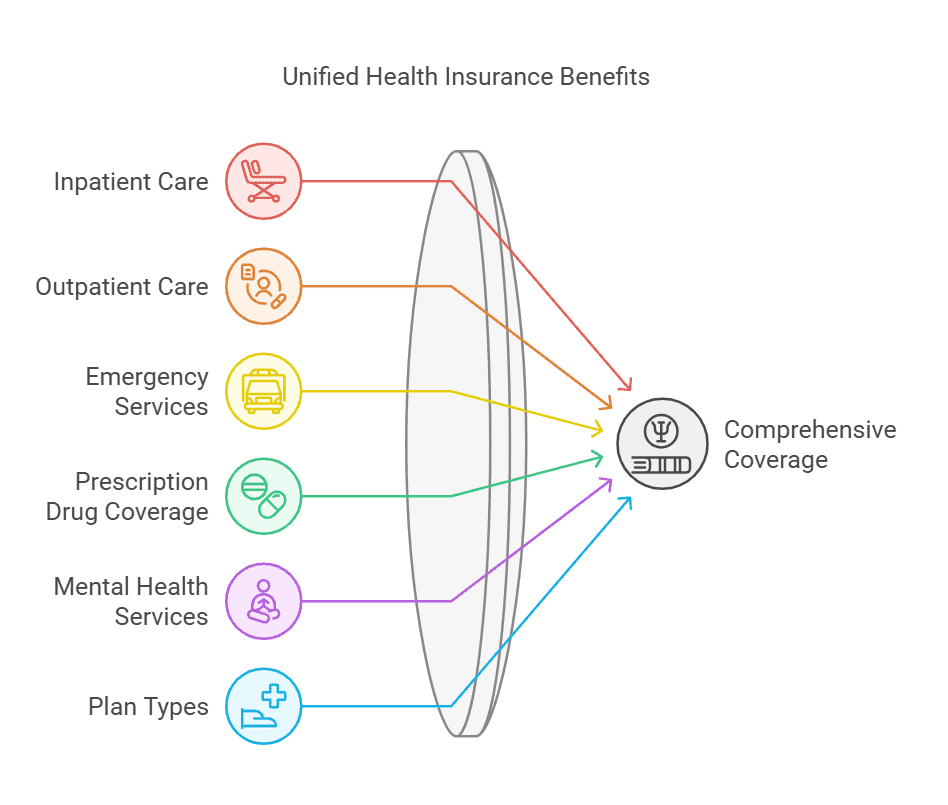

1. Inpatient vs. Outpatient Coverage

- Inpatient Care: Most comprehensive health insurance plans cover hospital stays, including room charges, medications, nursing care, and surgeries.

- Outpatient Care: Many plans also cover outpatient visits, allowing policyholders to access diagnostic tests, consultations, and treatments without being admitted.

Example: A 2023 study by the Kaiser Family Foundation revealed that 80% of employer-sponsored health plans offer full inpatient coverage but vary in outpatient benefits, depending on the plan type.

2. Emergency Services

Emergency care is a cornerstone of health insurance. By law, under the Affordable Care Act (ACA), all health plans must cover emergency services without requiring preauthorization, regardless of whether the hospital is in-network.

3. Prescription Drug Coverage

Many hospital stays require medications, which are typically covered under the prescription drug benefits of a medical plan. Comprehensive plans ensure that these costs are either partially or fully reimbursed.

4. Mental Health and Substance Abuse Services

Mental health services are increasingly recognized as essential. Modern medical plans include coverage for psychiatric hospitalizations and substance abuse treatments, aligning with the Mental Health Parity and Addiction Equity Act.

Types of Medical Plans: Which Cover Hospital Services Best?

1. Health Maintenance Organization (HMO) Plans

- Advantages: Lower premiums and predictable out-of-pocket costs.

- Limitations: Requires using in-network hospitals and preauthorization for specialized care.

2. Preferred Provider Organization (PPO) Plans

- Advantages: Flexibility to use out-of-network hospitals, though at higher costs.

- Comprehensiveness: Typically offers extensive hospital and specialty care coverage.

3. Exclusive Provider Organization (EPO) Plans

- Advantages: Similar to PPOs but with lower premiums.

- Limitations: Coverage is limited to in-network hospitals, except for emergencies.

4. High Deductible Health Plans (HDHPs)

- Advantages: Lower premiums, paired with Health Savings Accounts (HSAs) for managing expenses.

- Challenges: High out-of-pocket costs before meeting the deductible.

Hospital Challenges and How They Relate to Health Insurance

1. Rising Healthcare Costs

Hospitals face significant financial pressure due to increasing operational costs, including advanced medical technologies, specialized staff, and regulatory compliance. According to a 2024 Commonwealth Fund report, hospitals saw a 7% rise in operational costs in 2023 alone.

Health insurance helps mitigate this by ensuring patients can afford care. Plans with robust hospital coverage reduce instances of unpaid medical bills, a common issue for uninsured patients.

2. Uninsured Patients

Hospitals often absorb the costs of treating uninsured individuals. In 2023, the American Hospital Association reported $42 billion in uncompensated care, underscoring the critical role of health insurance in alleviating financial strain on healthcare providers.

3. Staffing Shortages

A shortage of healthcare professionals affects hospital efficiency and care quality. Comprehensive medical plans that include wellness programs can help address this issue by keeping patients healthier and reducing hospital admissions.

Conclusion: Why a Medical Plan is Key to Accessing Hospital Insurance

A well-designed medical plan is essential for accessing comprehensive hospital services, from emergency care to specialized treatments. As hospitals face challenges like rising costs and uninsured patients, health insurance plays a crucial role in bridging the gap between patient needs and healthcare providers’ capabilities.

By partnering with experts like PEO4YOU, individuals and businesses can find the best health plan options, ensuring that hospital services are accessible, affordable, and tailored to their unique needs. Trust PEO4YOU to guide you in choosing the right plan, because medical plan coverage is not just about affordability—it’s about securing the care you deserve.