Health insurance is an essential tool for managing healthcare costs, ensuring access to critical medical services, and protecting financial well-being. In the United States, millions of people rely on health insurance, but not all plans offer the same value or benefits. Knowing what makes for better health insurance and understanding the most common plans can help individuals and small business owners make informed decisions.

In this article, we’ll explore the health insurance plans most commonly purchased in the U.S., the facts people often overlook, and the significant improvements seen in 2023 and 2024.

What Makes a Health Insurance Plan “Better”?

1. Comprehensive Coverage

Better health insurance includes coverage for essential health benefits such as preventive care, hospitalization, prescription drugs, mental health services, and maternity care. According to the Affordable Care Act (ACA), all marketplace plans must provide these benefits, ensuring a baseline level of care.

2. Affordable Premiums and Out-of-Pocket Costs

Good health insurance plans balance premiums with manageable deductibles, co-pays, and out-of-pocket maximums. A 2024 report by the Kaiser Family Foundation noted that average premiums for employer-sponsored plans increased by 6%.

3. Accessibility

A plan’s network should include a wide range of in-network doctors, specialists, and hospitals. Limited networks can increase out-of-pocket expenses if care is sought outside the network.

4. Flexibility for Changing Needs

A better plan allows individuals to adjust coverage as their healthcare needs evolve, such as adding dependents or accessing specialists.

The Most Common Health Insurance Plans in the U.S.

1. Employer-Sponsored Health Insurance

Employer-sponsored plans remain the most common type of health insurance in the U.S., covering nearly 159 million Americans as of 2023. These plans often include:

- Health Maintenance Organizations (HMOs): Lower premiums, but restricted to in-network providers.

- Preferred Provider Organizations (PPOs): Higher premiums with the flexibility to see out-of-network providers.

- Exclusive Provider Organizations (EPOs): Similar to PPOs but without out-of-network coverage.

2. Marketplace Plans (ACA)

Individual plans purchased through the ACA marketplace are popular among freelancers, sole proprietors, and small business owners. These plans are categorized into four tiers:

- Bronze: Low premiums, high out-of-pocket costs.

- Silver: Moderate premiums and out-of-pocket costs, often subsidized for low-income families.

- Gold: Higher premiums, lower out-of-pocket costs.

- Platinum: Highest premiums, lowest out-of-pocket costs.

Reported by Healthcare.gov, 80% of marketplace enrollees in 2024 received subsidies, making coverage more affordable.

3. Medicaid and CHIP

Medicaid and the Children’s Health Insurance Program (CHIP) provide low-cost or free coverage to eligible individuals and families. Recent expansions under the ACA have increased enrollment, particularly in states adopting the Medicaid expansion.

4. Medicare

Medicare primarily serves individuals aged 65 and older, covering hospitalization (Part A), medical services (Part B), and prescription drugs (Part D). Medicare Advantage plans, offered by private insurers, provide additional benefits like dental and vision coverage.

5. High Deductible Health Plans (HDHPs) with HSAs

HDHPs paired with Health Savings Accounts (HSAs) are becoming increasingly popular due to their low premiums and tax advantages. These plans are ideal for healthy individuals who rarely need medical services.

Facts People Tend to Overlook About Health Insurance

1. Preventive Services Are Often Free

Under ACA guidelines, most plans cover preventive services like vaccinations, screenings, and annual check-ups without co-pays.

2. Mental Health Coverage is Required

The Mental Health Parity and Addiction Equity Act ensures that mental health benefits are equal to physical health benefits, yet many individuals are unaware of the extensive services included.

3. Out-of-Network Costs Can Be Prohibitive

Even with a good health insurance plan, using out-of-network providers can lead to significantly higher costs. According to a 2024 report by the Commonwealth Fund, 45% of insured Americans faced unexpected medical bills, many due to out-of-network charges.

4. Telehealth is Expanding

Telehealth services, which became widely adopted during the COVID-19 pandemic, are now standard in most plans. They provide affordable access to healthcare, particularly for rural residents.

Improvements in Health Insurance Plans in 2023 and 2024

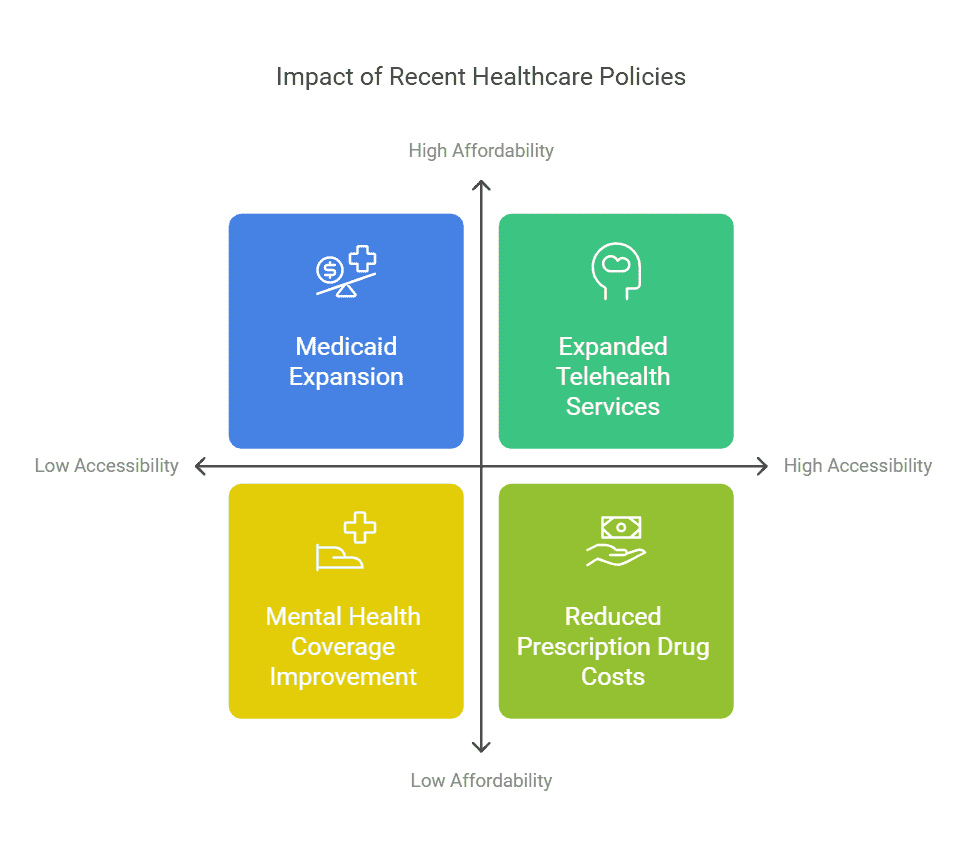

1. Enhanced Subsidies for ACA Marketplace Plans

The American Rescue Plan Act’s enhanced subsidies were extended through the 2025 plan year, ensuring more affordable coverage for low- and middle-income families.

2. Expanded Telehealth Services

A 2024 CDC report highlights that telehealth services are now covered for mental health, chronic disease management, and even specialized care in most plans.

3. Greater Access to Medicaid

New Medicaid expansion states like South Dakota and North Carolina have increased coverage for low-income adults, reducing the uninsured rate.

4. Reduced Prescription Drug Costs

The Inflation Reduction Act introduced price caps for insulin and other medications under Medicare, benefitting millions of Americans.

5. Improved Mental Health Coverage

Employers are increasingly including mental health services in their health plans, addressing issues like burnout and workplace stress.

How PEO4YOU Helps You Find Better Health Insurance

Navigating the complexities of health insurance can be overwhelming, especially when seeking good health insurance plans tailored to individual or business needs. As an intermediary, PEO4YOU bridges the gap between people and insurance providers, offering personalized guidance to ensure clients find better health insurance options.

1. Tailored Recommendations

PEO4YOU evaluates your specific needs—whether you’re a sole proprietor, small business owner, or independent contractor—and matches you with plans that balance cost and coverage.

2. Access to Top Providers

By working with a network of trusted insurance companies, PEO4YOU ensures you have access to the best health insurance options in your area.

3. Simplified Enrollment Process

PEO4YOU helps clients navigate enrollment, ensuring they understand their options and avoid common pitfalls like choosing inadequate coverage or missing deadlines.

Conclusion: Why Better Health Insurance is Within Reach with PEO4YOU

In a healthcare system full of complexities, finding better health insurance can feel like a daunting task. Understanding the most common plans, their benefits, and recent improvements is crucial for making informed decisions. Whether you’re seeking individual coverage or a comprehensive plan for your small business, better health insurance is about balancing affordability, accessibility, and comprehensive care. With PEO4YOU as your guide, you can confidently navigate the world of health insurance, connecting with good medical plans tailored to your needs. As an intermediary, PEO4YOU ensures that finding the right plan is straightforward and stress-free, empowering you to focus on what truly matters—your health and well-being.