In the fast-paced world of business today, it's essential for companies aiming to recruit and retain the best employees to provide a comprehensive benefits package that includes small group health insurance as a key offering. The provision of health care not only ensures the well-being and engagement of your workforce but also plays a vital role in keeping your business ahead in the competitive market landscape.

In this article, we will delve into the choices offered in small business health insurance plans. We'll look at the plan options for small groups and compare them with large group health insurance policies. We will also offer information on small group health insurance costs and help business owners in selecting the best health coverage for their staff members.

Small business group health insurance is when small companies provide healthcare benefits to their workers and their families. Companies with fewer than 50 employees usually qualify for these plans. The aim of these plans is to give employees and their dependents access to health benefits at lower costs compared to individual plans.

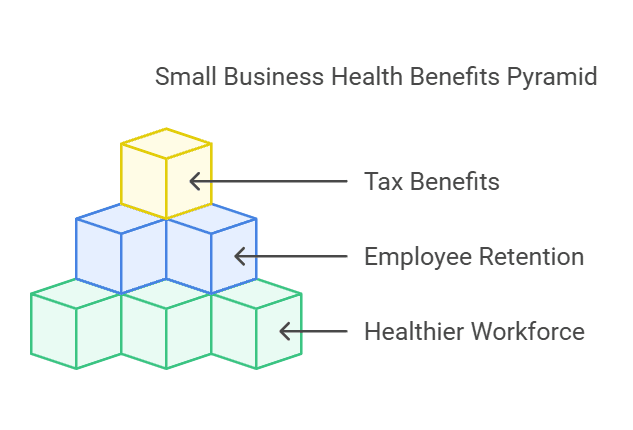

Small businesses benefit from offering health insurance as it promotes a positive workplace atmosphere and enhances employee contentment while decreasing staff turnover rates—an important aspect for companies depending on specialized talent. Moreover, providing health insurance could make small businesses eligible for tax benefits, ultimately reducing their financial burdens.

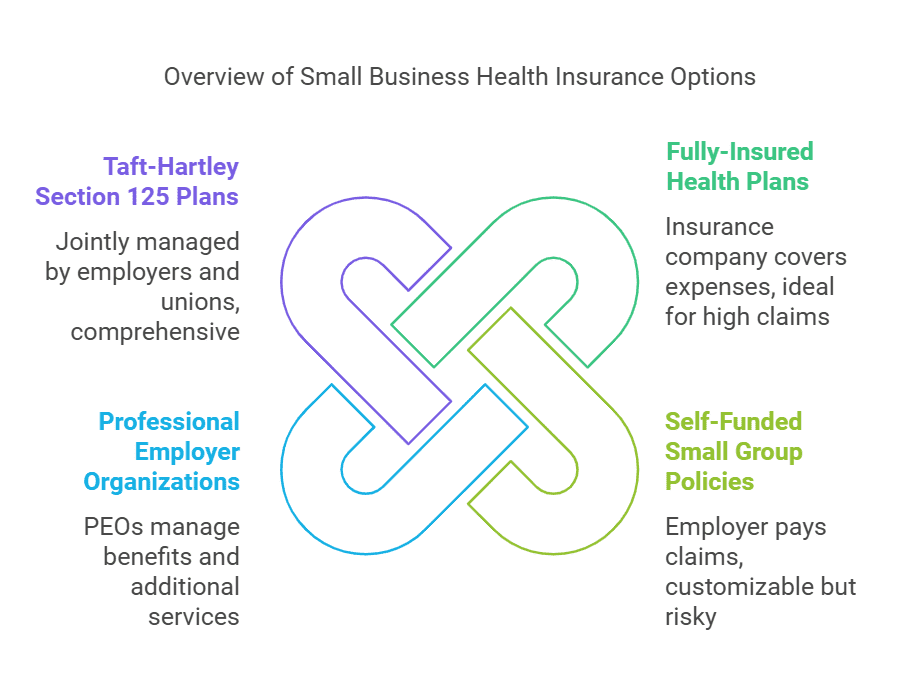

In the realm of group health insurance for businesses, the fully-insured health plan stands out as the prevailing choice. The small business commits to a premium paid to an insurance provider in this scenario. The insurance company shoulders the burden of healthcare expenses, simplifying the process and ensuring predictability. Financially, these plans work best for companies with a lot of medical claims.

Employer health plans that are funded independently are not widely used by small businesses; however, they can prove to be economical under certain circumstances. The employer is responsible for paying healthcare claims in a self-funded plan and takes the risk of potential higher medical expenses. This approach enables a degree of customization for health benefits but necessitates thorough assessment owing to the risks involved.

Small businesses often opt for Professional Employer Organizations (PEOs) to handle employee health benefits without having to deal with the tasks themselves. These organizations team up with businesses to offer health insurance packages along, with additional perks such as payroll, workers' compensation, and HR services.

Taft-Hartley 125 plans are group health and welfare plans created under the Taft-Hartley Act and are typically managed collaboratively by employers and labor unions. These plans offer premiums, copays, deductibles, and access to a wide network of healthcare providers. PEO4YOU stands out as a professional employer organization offering Taft-Hartley 125 plans that come with comprehensive benefits and do not require any adjustments to payroll or workers' compensation policies. This makes it an appealing choice for small businesses.

Health Maintenance Organization (HMO) plans provide access to a group of healthcare providers that employees need to visit for insurance coverage to apply effectively within the plan's guidelines and requirements. These types of plans are often more budget-friendly; however, they do have restrictions when it comes to selecting a healthcare provider outside of the network. For businesses aiming for cost-effective solutions for employee healthcare coverage, opting for an HMO could be a wise decision.

Preferred Provider Organization (PPO) plans offer flexibility by enabling employees to see any healthcare provider without needing a referral. PPO plans typically come with higher premiums compared to other options but offer a broader selection of providers, a feature that appeals to businesses looking to provide thorough coverage for their employees.

EPO plans merge aspects of HMO and PPO models where employees are required to visit in-network providers without referrals for treatment while offering a mix of cost-effectiveness and service options.

Group health insurance varies based on group size and company eligibility requirements in terms of cost and regulations. Small group plans cater to businesses with fewer than 50 employees, while large group health insurance is meant for companies with 50 or more employees.

Provided that small businesses offer group health insurance, they can benefit in several ways:

For a company to qualify for small business group health insurance, it needs to have a staff size ranging from one to fifty employees. As per standard practice, most insurance providers mandate that a minimum of 50% or 70% of eligible employees must enroll in the plan to qualify for coverage. This requirement aids in distributing the risk evenly and guarantees the sustainability of the insurance plan for the provider.

Employers typically need to cover at least half of the costs for employees' insurance premiums, which not only makes the plan more budget-friendly for employees but also boosts enrollment rates.

When you're searching for the best group health insurance for small businesses, there are several important aspects to take into account:

Small businesses can choose from a range of group health insurance plans provided by companies like Humana, UnitedHealthcare, and Blue Cross Blue Shield to provide coverage at competitive rates.

The cost of group health insurance for a small business can fluctuate depending on the location of the business, the ages of its employees, and the specific insurance plan selected.

These costs can be reduced if the company qualifies for tax breaks or if employees opt for plans with higher deductibles and lower premiums.

A small marketing firm with 15 staff members faced challenges in securing a budget-friendly group health coverage option for their team members until they discovered a PPO plan that stood out for its versatility and comprehensive benefits among other small business group health insurance plans available on the market. Utilizing the Small Business Health Care Tax Credit enabled the agency to slash costs by 35%, making health insurance accessible and affordable for both the company and its employees.

An IT consulting firm with 10 employees was dealing with rising health insurance expenses every year. To address this issue without having to make changes to their payroll or workers' compensation policies like traditional PEO services required, the owner decided to consider using PEO4YOU, which offered competitive rates that were especially beneficial for a workforce consisting of families and older employees. Switching to PEO4YOU allowed the company to access the Blue Cross Blue Shield (BCBS) PPO network and provided them with steady renewal rates that were unaffected by their claims history.

Providing small group health insurance is a wise choice for small businesses looking to invest in their employees' well-being and productivity. It not only aids in the recruitment and retention of staff but also fosters a healthier work environment. By diving into the kinds of group health insurance plans tailored for small businesses and evaluating costs and alternatives carefully, business owners can identify the most suitable plan that aligns with their financial constraints and meets their employees' requirements effectively.

If you're thinking about providing health insurance or looking to compare your current plan with other choices out there, it's a smart move to reach out to a small group health insurance broker for advice and support tailored to your needs in understanding the ins and outs of health insurance for small businesses.

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.

Small Business Owners Group Health Insurance Handbook