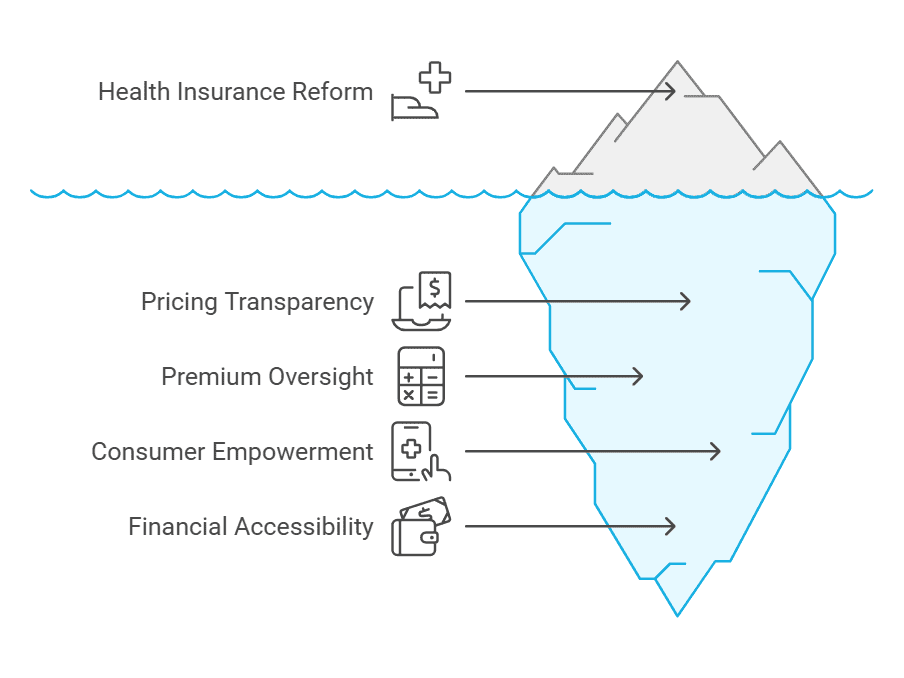

Healthcare insurance is vital to providing access to necessary medical care, but with the ongoing evolution of the healthcare system, legislative and regulatory changes play an essential role in shaping its future. In 2024, significant updates to healthcare regulations aim to increase accessibility, reduce costs, and address challenges related to the availability and affordability of coverage. In this article, we will delve into the key regulatory updates, new state regulations, and the federal government’s efforts to improve healthcare insurance options.

Medicaid, a cornerstone of affordable healthcare, has expanded further in 2024. States like South Dakota and North Carolina have extended eligibility to individuals earning up to 138% of the federal poverty level, granting millions of Americans access to vital healthcare services.

Why Medicaid Expansion Matters:

States that have expanded Medicaid report fewer disparities in healthcare access, better health outcomes, and lower rates of medical debt among residents.

The ACA’s premium subsidies, initially expanded under the American Rescue Plan, have now been made to extend until the end of 2025. These subsidies cap the percentage of income spent on premiums, ensuring low- and middle-income households can afford coverage.

Impact of Subsidies:

In 2022, Colorado launched its public option and Nevada is on track to offer their public option in 2026. These state-run plans offer a low-cost alternative to private insurance while driving competition in the private market to lower premiums.

New federal regulations now require private insurers to disclose upfront pricing for medical services and treatments.

Why This Matters:

To make private insurance more affordable, health insurance subsidies and competition have helped make plans more affordable.

Despite progress in expanding Medicaid and increasing ACA subsidies, coverage gaps still exist. Many individuals fall into a gap where they earn too much to qualify for Medicaid but too little to afford private health insurance plans. This issue is especially prevalent in states that have not expanded Medicaid.

Employers continue to be pivotal in providing healthcare coverage, with regulatory updates in 2024 further expanding employee benefits.

Employers are increasingly encouraging the use of HSAs, which allow employees to save pre-tax dollars for medical expenses.

The healthcare system in 2024 has undergone transformative changes, with Medicaid expansion, permanent ACA subsidies, and public health insurance options improving accessibility and affordability. While these changes provide new opportunities, navigating the evolving landscape can be complex.

PEO4YOU Health Plans serve as a crucial intermediary, connecting individuals, small business owners, and independent contractors with health care providers. By simplifying the process, clients find tailored solutions that meet their specific needs—whether exploring Medicaid, the Health Insurance Marketplace, or private insurance options.

With PEO4YOU, you gain access to expert guidance and support in selecting comprehensive, affordable coverage. Whether you're a small business owner managing employee benefits or an individual seeking personal coverage, we bridge the gap, making healthcare insurance more accessible and manageable.

Explore the possibilities with PEO4YOU and secure a plan that prioritizes your health and financial security in 2024.

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.