Small businesses up to 100 employees (5-50 employees tends to be the sweet spot) can benefit from working with a Professional Employer Organization (PEO), which offers a range of HR services such as managing payroll and tax filings, along with ensuring compliance and providing group health insurance and benefits coverage for employees. By teaming up with a PEO as an employer partner, small businesses can access cost-effective health insurance options that are typically more difficult to secure without such collaboration.

When your company partners with a Professional Employer Organization (PEO), your employees gain access to healthcare benefits that might typically be out of reach for smaller businesses. But how does this work? Let's break it down.

A PEO extends the concept of co-employment, which means it merges your employees with those from other businesses into one large employee pool. This collective group allows the PEO to negotiate better rates and benefits with insurance providers.

These competitive rates and robust benefit options often directly translate to significant savings for both employers and employees. Smaller companies can offer attractive health benefits without the prohibitive costs usually associated with top-tier plans.

By joining forces with a PEO, your employees not only receive valuable health coverage but also enjoy the same advantages typically reserved for larger corporations.

Health insurance offered by PEOs is incredibly beneficial for small businesses facing challenges in offering top-notch health coverage because of high premiums. PEOs negotiate with health insurers to secure better rates by combining employees from client companies under their umbrella. This approach leads to lower costs and improved coverage options for all involved. As a result of this arrangement, even small businesses with a small number of employees can provide their workforce with comprehensive health insurance packages. In a competitive job market, providing such perks can enhance your company’s appeal to highly skilled professionals.

One major benefit of PEO health insurance is the savings on costs it offers by using the combined purchasing power of all its clients to negotiate rates for group health coverage and ancillary benefits, resulting in more budget-friendly rates for employees than what small businesses could secure independently. For instance, a study conducted by the National Association of Professional Employer Organizations (NAPEO) revealed that companies utilizing PEO services save an average of 35% on healthcare expenses.

Professional Employer Organizations (PEOs) provide a range of health insurance options, such as coverage for vision care services that often come with broader networks and enhanced benefits than what small businesses can typically obtain on their own. Collaborating with a PEO enables businesses to offer comprehensive health insurance plans that encompass healthcare services, wellness initiatives, and the opportunity to connect with top-notch healthcare providers.

Providing health insurance involves plenty of paperwork tasks like overseeing employee enrollments and ensuring adherence to healthcare regulations. PEO services cover all the duties related to providing health insurance. This helps small business owners save time and stay compliant with laws like the Affordable Care Act (ACA) and new state regulations such as required employees trainings, minimizing the chances of facing penalties and fines.

Health insurance packages for employees can differ, but they usually consist of:

Small businesses find PEO group health insurance appealing as it offers comprehensive coverage for their employees' well-being and healthcare needs.

PEO health insurance rates for employees are often lower because of the combined risk and purchasing leverage of the PEO entity involved in the process. The rates are influenced by factors like company size, coverage options selected, as well as employee health conditions. On average, PEO health insurance plans tend to be 10 to 20 percent cheaper than plans acquired directly by businesses.

Understanding the distinction between a Professional Employer Organization (PEO) and a staffing company is crucial for businesses seeking the right type of employment support. Both entities can assist in managing a workforce but serve distinct roles and functions.

A PEO functions as a co-employer, sharing responsibilities with your business. This means they handle various HR duties, including:

By partnering with a PEO, companies can leverage the expertise of seasoned HR professionals, allowing them to focus on core business activities while ensuring efficient HR management.

A staffing company, on the other hand, primarily focuses on recruiting and placing employees. They are ideal for businesses needing:

While staffing companies manage the recruitment process, the hiring business remains the sole employer of the recruited staff, taking on HR responsibilities once a candidate is placed.

Choosing between a PEO and a staffing company depends on your business needs. If you seek comprehensive HR solutions and risk management, a PEO might be the best fit. For rapid recruitment and flexible staffing, a staffing company could be the right choice.

To ensure that a Professional Employer Organization (PEO) partnership continues to meet your evolving business needs, regular communication is key. Here's how to maintain a successful collaboration:

Utilizing these strategies not only aligns your PEO partnership with your business's current needs but also supports its growth and adaptation over time.

Navigating workers' compensation insurance can be a daunting task for many businesses. However, partnering with a Professional Employer Organization (PEO) offers a seamless approach to managing this obligation. Here's how you can secure workers' compensation through a PEO:

By collaborating with a PEO, your business can streamline the workers' compensation process, allowing you to focus on core operations while ensuring your employees are covered effectively.

A co-employment agreement with a Professional Employer Organization (PEO) is a collaborative arrangement designed to streamline management tasks and enhance your business operations.

When you enter into this agreement, the PEO becomes the employer of record for your workforce. This means they handle critical responsibilities like payroll processing, tax compliance, and benefits administration. Consequently, your employees receive paychecks and tax documents under the PEO's name.

However, it's important to note that you retain complete control over the core functions of your business. Decisions related to daily operations, employee tasks, and strategic direction remain solely in your hands. By sharing administrative duties, you can focus more on growth and less on paperwork.

In summary, a co-employment agreement allows you to benefit from the expertise and resources of a PEO, while maintaining full authority over how your company operates.

In the realm of workforce management, co-employment and employee leasing often get confused, but they represent different forms of business relationships.

Co-employment involves a partnership typically seen in Professional Employer Organizations (PEOs). Here’s how it works:

Employee leasing is a different scenario, often associated with staffing agencies. Here’s the breakdown:

Understanding these distinctions helps businesses choose the right strategy for their staffing and HR needs. Co-employment suits organizations seeking continuous support and shared HR functions, while employee leasing caters to temporary or project-based staffing requirements.

Small businesses face a major hurdle in securing health insurance due to the high costs involved and their lack of negotiating leverage compared to larger companies. PEO health insurance offers a solution by providing cost-effective coverage that small businesses may not have access to otherwise.

Managing health insurance internally involves a lot of administrative work. Dealing with paperwork and ensuring compliance with healthcare regulations takes up significant time for business owners and distracts them from their primary business operations. Professional Employer Organizations (PEOs) help ease this workload by handling tasks such as employee enrollments and compliance issues, so that business owners can dedicate their attention to growing their business and improving productivity.

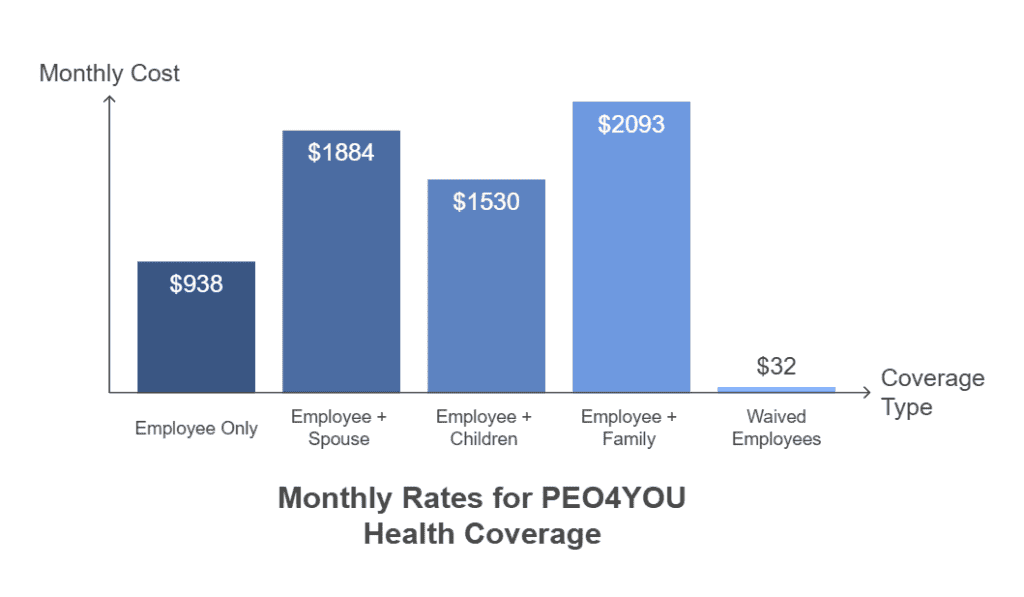

PEO4YOU is unique among Professional Employer Organizations because it doesn't mandate businesses to switch their payroll provider or workers’ compensation policy like most other PEOs do. This flexibility enables business owners to keep their existing payroll system and workers’ compensation policy without any interruptions while also enjoying the excellent health benefits, such as dental and vision plans, provided by PEO4YOU.

PEO4YOU stands out by providing stable premiums that do not depend on the age and health of employees. This sets it apart from regular PEO services where renewal costs often rise based on claims usage data. The typical renewal rate increase for PEO4YOU over five years is below 16%, contrasting with the national average of 40%. PEO4YOU also manages COBRA coverage to ensure former employees can still access healthcare—a valuable service for numerous small businesses.

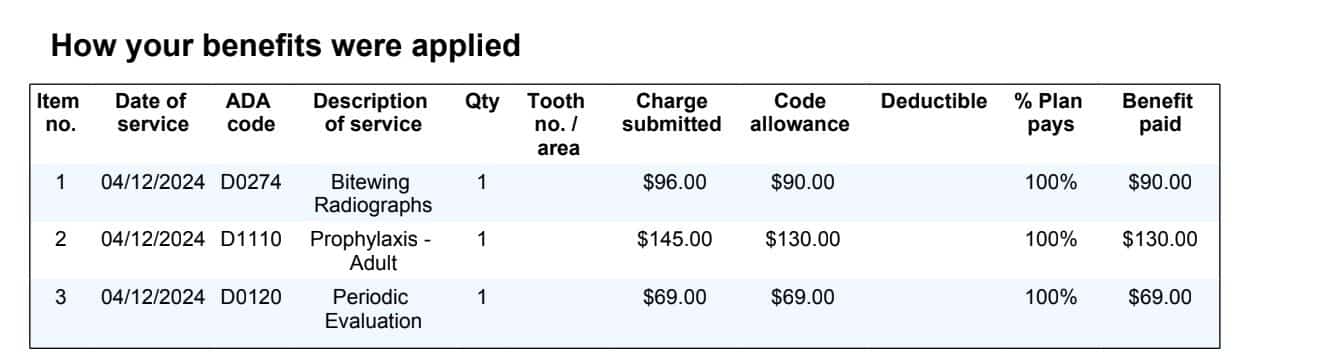

Here are the rates for PEO4YOU:

These rates provide comprehensive coverage, including medical, dental, vision, and life insuranceReal-World Examples Showcasing the Benefits of PEO Health Insurance

Sarah, a small business owner with 15 employees, faced challenges in providing affordable health insurance for her team members. Collaborating with a PEO enabled her to secure a PEO health insurance plan that offered improved coverage at a budget rate compared to what she could source independently. By joining forces with the PEO scheme, she ensured that her employees had access to the healthcare options offered by the Blue Cross Blue Shield PPO network. This stability in premiums and cost-effectiveness freed up resources for Sarah to reinvest in other aspects of her business operations.

David manages a company that employs 25 individuals, with many of them supporting families. The average age of his team is on the higher side when compared to other businesses in the same industry category. Upon exploring Professional Employer Organization (PEO) alternatives, he found that the options quoted had higher rates due to the team members’ average age being higher. Fortunately, David discovered a cost-effective solution through PEO4YOU, which didn't necessitate altering their current payroll or workers’ compensation arrangements. PEO4YOU was the perfect fit for David's business due to its fixed rates and access to the Blue Cross Blue Shield PPO network, enabling him to offer top-tier healthcare benefits within his budget constraints.

Sam Newland shared that health insurance offered by a PEO (Professional Employer Organization) can make a significant difference for small businesses and independent contractors by leveraging risk pooling among various companies to provide competitive rates and coverage choices that may not be accessible otherwise to many small businesses.

According to a study by NAPEO, companies utilizing PEO services experience a decrease in employee turnover rates by up to 40%. This improvement can be attributed to the health benefits provided by PEO partnerships and emphasizes the significance of PEO health insurance in retaining employees and driving business prosperity.

When selecting a PEO for health insurance, coverage for your business needs must be evaluated first and foremost. Think about the size, health, demographics of your workforce, the types of benefits you aim to provide, and your financial constraints. Bear in mind that not all PEO service providers are the same, hence it is vital to discover one that aligns with your needs.

When you're reviewing health insurance rates from Professional Employer Organizations (PEOs), it's important to consider not only the premiums but also the range of coverage they offer. Some of these organizations might advertise lower premiums; however, they could have restricted networks or higher employee out-of-pocket expenses. It's crucial to select a reliable provider that offers comprehensive coverage that benefits both your company and its employees effectively.

One important consideration when choosing the PEO for health insurance is the network of providers they offer. For comprehensive coverage, it's preferable to opt for a PEO that provides a PPO network, like Blue Cross Blue Shield. This enables your employees to have a broad choice of healthcare providers nationwide, giving them the freedom to select their preferred healthcare professionals.

PEO health insurance provides an option for enterprises, independent contractors, and sole proprietors who aim to offer thorough health coverage without straining their budgets. By utilizing the group buying influence of a PEO service provider, small businesses can secure pricing options, broader coverage, and efficient administrative assistance. This not only aids in expense management but also enhances the appeal of your business to potential employees.

If you're a business owner seeking budget-efficient health insurance solutions for your employees, it is crucial to consider teaming up with a Professional Employer Organization (PEO). By opting for a PEO partnership, you can access advantages such as reduced expenses, improved insurance coverage, and streamlined administrative tasks, which can play a key role in providing top-tier health insurance benefits to your workforce.

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.