Many people worry about how to keep their health insurance when they work flexibly, especially those who work part-time or run their own businesses. Quality healthcare coverage options exist outside of traditional full-time employment through different available strategies. Workers today benefit from a variety of healthcare options including Part-Time Jobs with Health Insurance, Medicaid, the Affordable Care Act (ACA), and Professional Employer Organizations (PEOs).

This guide presents a detailed examination of how employees can access health insurance through part-time jobs without needing to take on full-time work responsibilities. This guide will feature businesses that provide health insurance benefits to part-time workers and will explore affordable healthcare options for self-employed people.

Health insurance is often thought to be exclusive to full-time workers yet numerous large employers extend benefits to their part-time staff. Individuals seeking both a flexible work schedule and health insurance coverage should consider part-time employment options that provide health benefits.

Selecting part-time positions that provide health insurance benefits is useful for those who expect income fluctuations which could impact their Medicaid eligibility because employer-sponsored coverage provides additional protection.

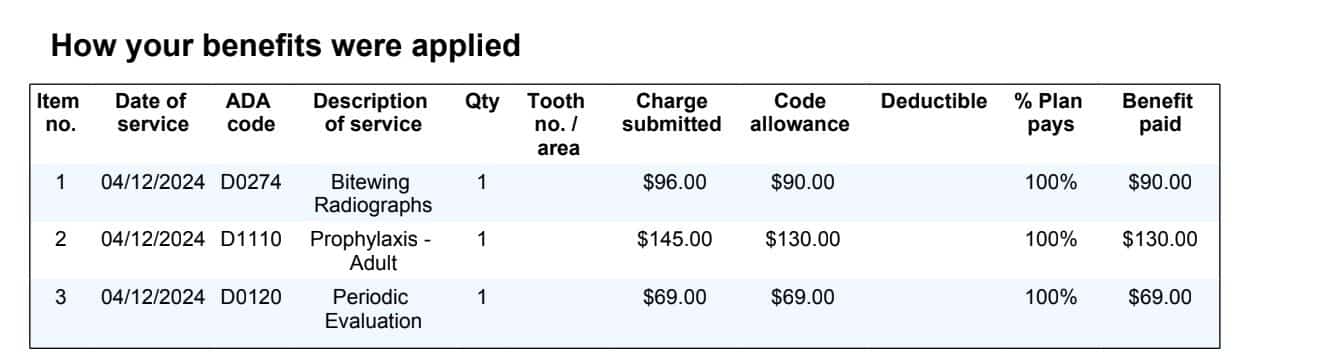

Numerous recognized businesses extend health insurance benefits to their part-time workforce. These organizations deliver outstanding healthcare options to part-time staff members:

People who want both flexible work schedules and quality health insurance should consider part-time positions at these companies which offer health benefits.

Self-employed individuals cannot access employer-sponsored health plans but they still have options to obtain health coverage. Independent workers have multiple effective options that enable them to keep their flexibility intact while obtaining dependable health insurance coverage.

The ACA has played a critical role in making healthcare options accessible for individuals who are self-employed. Independent workers access customizable insurance through marketplace plan enrollment which matches their financial and health needs. The ACA successfully expanded healthcare access demonstrated by a record number of workers who received coverage through the program (Inc.).

Self-employed workers seeking both work autonomy and complete health coverage should consider enrolling in ACA marketplace plans. Certain self-employed workers identify Part-Time Jobs with Health Insurance as a backup or additional source to maintain consistent health coverage when their income varies.

Part-time workers with low income can obtain health coverage through Medicaid while avoiding substantial out-of-pocket expenses. Part-time workers can secure Medicaid coverage in several states when their income meets eligibility standards. Policy debates are underway about introducing work requirements for Medicaid beneficiaries which may affect people who depend on this program for healthcare while they work variable hours.

Certain states require able-bodied Medicaid beneficiaries to either work designated hours or take part in job training and community service to keep their benefits. Individuals who work part-time jobs need to understand these policies to find affordable healthcare solutions.

Searching for part-time employment that includes health insurance benefits serves as a proactive strategy. A shift in Medicaid eligibility criteria makes employer-sponsored benefits essential to maintain continuous health coverage.

Through their intermediary role between individuals and insurance companies PEOs provide access to competitive healthcare plans which independent workers would not normally be able to obtain. PEO4YOU and similar organizations focus on assisting self-employed workers in locating health insurance options that align with their distinct professional situations.

Independent professionals should consider PEO services such as PEO4YOU to achieve health benefits with maintained work flexibility.

Working part-time or running your own business allows you to keep health insurance benefits while maintaining flexible work options. The essential step is to evaluate available choices and choose a strategy that fits personal needs best.

Strategic planning enables people to maintain work flexibility along with reliable healthcare coverage. Part-Time Jobs with Health Insurance offer an ideal solution for individuals who wish to work reduced hours and maintain employer benefits. Self-employed people have multiple healthcare options including ACA marketplace plans, Medicaid eligibility and PEO service benefits.

People who want work flexibility along with dependable health coverage should consider Part-Time Jobs with Health Insurance as a practical solution. Maintaining your health coverage through employer-sponsored insurance, ACA marketplace plans, Medicaid or PEO services lets you prioritize your career and lifestyle along with your well-being.

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.