Explore the best dental insurance plans for self-employed individuals, with tips to save money, compare coverage types, and maximize tax benefits.

Self-employed professionals gain freedom and flexibility which allows them to establish their unique career trajectory. This newfound independence carries the weight of responsibility which becomes particularly critical regarding health and dental insurance. Freelancers along with gig workers and business owners need to search independently for their own health and dental insurance coverage unlike traditional employees.

The situation becomes critical because more than 68 million Americans do not have dental insurance coverage. High dental care costs result in substantial out-of-pocket payments for patients who do not hold coverage and even those who have basic insurance plans.

This article explains everything about self-employed dental insurance along with the best plans available and tips to manage costs while exploring coverage options.

When you operate as a self-employed individual you manage both your business leadership role and your human resources responsibilities. As a self-employed person you need to manage your health requirements which must include dental services.

Health insurance coverage is absent for 25% of self-employed workers which shows a wider problem of insufficient insurance coverage in this group. Without adequate dental coverage, you risk:

Self-employed professionals can secure their health and budget effectively by obtaining dental insurance.

Self-employed professionals face difficulties when searching for dental insurance options. A proper understanding of available options of dental plans for self employed allows you to make confident choices that suit your specific requirements.

DHMO plans serve as a widely favored choice for budget-conscious individuals who value preventive dental care. A DHMO plan requires you to select a primary care dentist from its network and obtain referrals for specialist visits.

The lower monthly premiums and minimal deductibles of these plans come at the cost of restricted provider options. Staying within the network ensures services receive full or majority coverage.

Key Features:

Self-employed persons consider Preferred Provider Organization (PPO) dental plans as their most adaptable insurance choices. Dental services can be obtained from both in-network and out-of-network dentists through these plans but choosing in-network providers will cost you less.

PPO plans have higher monthly costs compared to DHMOs yet offer broader coverage suitable for people who want to keep their dentist and for regular travelers.

Key Features:

Dental indemnity plans which are also known as fee-for-service plans enable you to choose any dentist without network restrictions. These plans reimburse you for a fixed percentage of your dental expenses based on an established fee schedule.

Self-employed people who value maximum provider choice or reside in rural areas without network access will find these plans ideal despite their higher premiums and increased paperwork requirements.

Key Features:

This option exists less frequently but suits individuals who value flexible access to dental care providers.

Discount dental plans provide financial benefits through special negotiated rates with participating dental offices compared to traditional dental insurance. Members pay yearly fees to get discounted rates for dental procedures such as cleanings and root canals.

Self-employed professionals who avoid monthly premiums or require mainly preventive maintenance and minor dental services find these plans particularly advantageous.

Key Features:

Multiple reputable businesses provide self-employed dental insurance options. Here are the most popular:

Delta Dental operates as one of America's biggest dental insurance providers by offering DHMO and PPO plans which cover preventive services such as cleanings and x-rays. The broad network of providers enables self-employed professionals to locate in-network dental service providers across the country.

Guardian Direct provides extensive dental insurance coverage starting at approximately $20 per month for services ranging from cleanings to major treatments including crowns and dentures. The platform operates intuitively while their customer support stands out to time-constrained freelancers.

Cigna combines affordability with strong preventive coverage. The plans provide free or low-cost cleanings and exams which allow access to nationwide networks that benefit both independent professionals and families.

Humana provides affordable dental insurance alongside special discount programs. These dental insurance options provide immediate preventive care access which makes them perfect for freelancers who require instantaneous dental services.

MetLife provides PPO plans that deliver comprehensive coverage throughout the nation and feature adaptability. Their plans fulfill family and individual requirements by providing preventive, basic and major services and are perfect for out-of-network seekers.

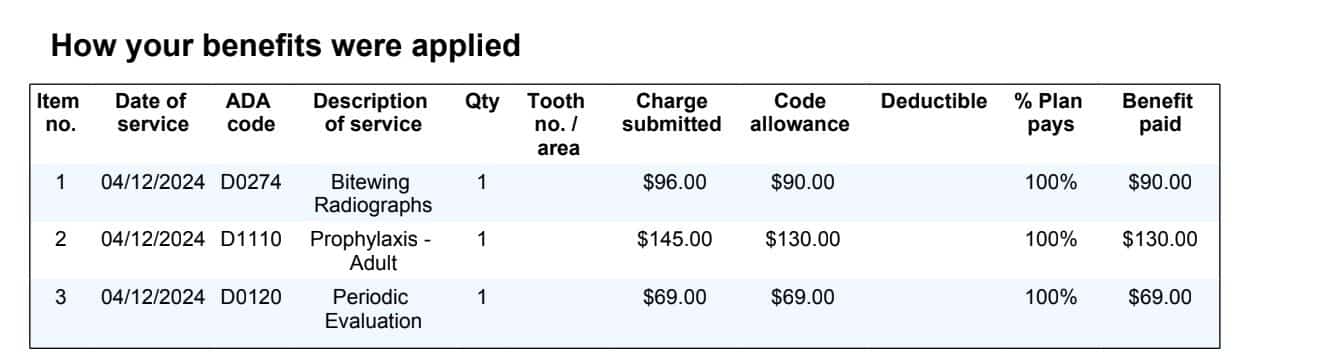

Self-employed individuals should familiarize themselves with included benefits when selecting dental coverage options.

Knowing your dental coverage benefits lets you maximize your self-employed dental insurance.

As a self-employed professional you need to select a dental insurance plan that fits both your needs and budget constraints. Set your most important criteria before selecting a dental insurance plan.

Starting with your monthly budget is essential when planning your dental insurance. Self employed people can find dental insurance with monthly premiums between $10 and $60 based on provider choice and coverage details as well as state regulations.

The true expense of your plan becomes clear only when you examine both the deductible amounts and the copayments alongside the monthly premium and the yearly maximum limits.

Verify whether your existing trusted dentist or specialist practices within your insurance plan's provider network. Dental insurance plans for self-employed individuals with larger PPO networks provide better flexibility enabling you to maintain your existing dental provider. DHMO plans typically mandate you to choose your primary dentist from a more limited network.

Digital nomads and traveling professionals who move between states need reliable access to dental care in multiple locations.

Consider what dental services you expect to require in the coming one to two years. Are routine dental checkups along with cleanings and x-rays the only coverage you require? Do ongoing dental conditions such as cavities or gum disease affect you or do you require orthodontic work?

When evaluating your plan options remember to check if orthodontic coverage is included because these benefits aren't usually part of basic insurance packages.

Not all dental insurance kicks in immediately. Waiting periods for both basic and major dental procedures extend from several months to a full year in many insurance plans. Preventive dental services including cleanings and exams typically receive immediate coverage while complex treatments necessitate a waiting period before being eligible for payment.

Some insurers provide an option to waive the waiting period for customers who had dental insurance coverage within the last 60 days.

A large number of freelance workers and contractors remain unaware that their self-employed dental insurance premiums may receive partial tax deductions.

The insurance covers preventive and necessary dental treatments but excludes cosmetic procedures including teeth whitening and veneers.

Claim self-employed health insurance deductions by filing Schedule 1 (Form 1040).*

Self-employed people need to select dental insurance that helps them save money and protects their health while offering peace of mind and maintaining work productivity by avoiding unexpected dental costs. Freelancers, gig workers, and small business owners who select appropriate self employed dental plans can sidestep expensive dental treatments while maintaining preventive dental care and accessing tax advantages over time.

Your journey to find affordable dental insurance for self employed that covers all aspects as a self-employed individual begins with understanding your specific requirements and financial limitations.

At PEO4YOU we recognize what self-employed individuals experience as distinct challenges when managing their business needs. Our goal is to provide independent professionals access to the top dental plans available for self-employed individuals which offer affordability and flexibility while being customized to match your lifestyle.

Ready to protect your smile? Get your free quote now. Your smile and future self will appreciate your decision.

*This is not tax advice. Consult a CPA for tax advice.

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.