Explore health insurance options for 1099 contractors and why offering coverage can benefit both workers and businesses

Today's workforce contains multiple 1099 workers including freelancers, graphic designers, and gig workers for example. The number of Americans working as freelancers or independent contractors exceeded 60 million by 2023 which constituted around 36% of the U.S. workforce. The number of Americans working as freelancers is expected to climb to 86.5 million by 2027 which will constitute 50.9% of the U.S. workforce.

1099 workers need to personally search for health insurance because their employers do not offer coverage. Studying all available health insurance options allows you to secure the right coverage although researching these options initially appears complex.

In fact, "1099 employee" is an incorrect term which properly refers to workers who operate as 1099 independent contractors. The correct term is 1099 independent contractor. This term describes self-employed workers who deliver services for companies as contractors without being acknowledged as employees of those companies.

The term “1099” comes from the IRS Form 1099-NEC that requires businesses to report payments exceeding $600 to independent contractors. Common examples of 1099 employees include:

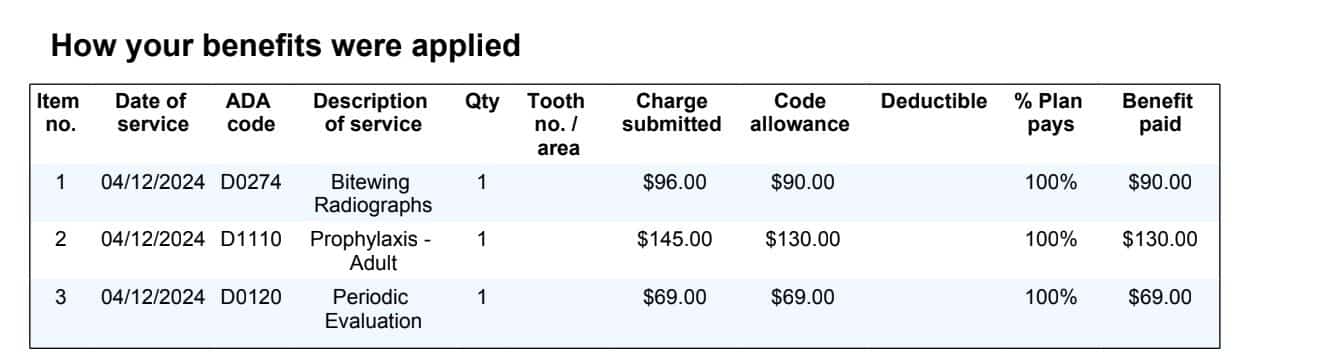

Understanding the differences between W-2 employees and 1099 contractors depends on recognizing their specific duties, responsibilities, and benefits. The table defines the fundamental distinctions between W-2 employees and 1099 contractors.

| Category | W-2 Employee | 1099 Contractor |

| Tax Withholding | Employer withholds taxes | Contractor handles their own taxes |

| Employment Status | Permanent/part-time employee | Independent/self-employed |

| Health Insurance | Often provided by employer | Must secure their own coverage |

| Benefits | Typically provided (PTO, 401k) | Not provided |

| Work Schedule | Set by employer | Flexible, set by contractor |

| Tools/Equipment | Provided by employer | May be provided by the employer but usually by the contractor |

| IRS Form | W-2 | 1099-NEC |

| Job Security | More stable | Project-based, less stable |

| Legal Protections | Covered by labor laws | Not covered by most employee laws |

The answer is no. Employers have no obligation to supply health insurance benefits to workers who are classified as 1099 contractors. The classification of 1099 workers as independent contractors means they are not traditional employees. As self-employed individuals they must arrange their own benefits coverage which includes health insurance.

Under the Affordable Care Act (ACA). businesses with over 50 full-time employees must provide health insurance to their W-2 workers but do not have to provide these benefits to 1099 contractors. Businesses have the choice to provide stipends or health plan access to 1099 workers as an optional benefit because they are not required by law to extend these benefits.

Given their employment status, 1099 workers need to find alternative healthcare coverage solutions such as marketplace plans or private insurance options.

Employers face no legal requirement to provide insurance benefits to their 1099 employees. Find out in the following section why choosing to offer insurance could be a beneficial decision for your company.

Businesses can gain a competitive edge by offering health insurance or healthcare stipends to 1099 contractors even though it's not a legal obligation. An organization that offers benefits like insurance can draw in and keep high-quality workers in today's competitive gig economy. Independent contractors work with numerous clients so health-related support from companies makes them stand out as the preferred business partner.

The implementation of insurance plans serves to establish durable partnerships with contractors and ensures workforce loyalty and consistency. Your organization will earn a reputation for being progressive and supportive because it prioritizes the well-being of all its partners and team members.

Some companies provide stipends and reimbursements or access to group health plans as benefits while designing these offerings to prevent contractors from becoming classified as employees by labor regulations.

Health insurance serves as a fundamental element in financial planning beyond being a mere safety net. 1099 workers need to find their own health insurance since they cannot receive coverage through employer-sponsored plans.

Independent contractors usually cannot access group insurance plans through employers but employers may provide them with other insurance alternatives.

Employers have questions about which health coverage options they can extend to their 1099 employees. Although it is not mandatory to supply health insurance for independent contractors, employers who offer coverage can strengthen their contractor benefits package, attract the best talent and boost employee satisfaction.

These represent the primary insurance options that 1099 employees can receive coverage through.

Employers are allowed to provide 1099 contractors with health insurance stipends that function as set monthly or yearly payments designed to aid contractors in paying for their health insurance premiums and medical costs.

Employers have no obligation to handle health insurance plans for 1099 workers yet providing a stipend can assist these workers with their healthcare expenses. The employer can deduct the stipend from their taxes but contractors will usually need to pay taxes on their received stipend.

All employers must specify stipends within contracts and comply with the necessary tax reporting regulations.

Employers have the ability to help 1099 workers secure individual health insurance coverage. Employers cannot provide group health insurance plans to independent contractors but they can support them by either funding their health coverage costs or helping them secure health insurance through the Health Insurance Marketplace.

1099 employees requiring temporary coverage can consider short-term health insurance as one available option. The benefits provided by these plans are restricted when compared to comprehensive health insurance plans yet they function as an economical choice for contractors who are healthy or those who are working between contracts.

Short-term health insurance plans provide fewer services compared to traditional insurance but suit independent contractors who require temporary coverage solutions. Businesses should assist contractors in evaluating the advantages and disadvantages of these plans and guide them towards providers with short-term health coverage options.

Employees who recently shifted from W-2 employment to independent contractor status qualify for COBRA continuation coverage. They can keep their employer-sponsored health insurance for up to 18 months after their job termination.

COBRA enables uninterrupted health insurance coverage but requires the individual to pay the full premium including both employer and employee contributions plus an additional 2% administrative fee. Many contractors choose COBRA as a short-term health insurance solution while they look for more cost-effective permanent coverage options.

Unique risks for independent contractors often result in expensive lawsuits and business financial losses. 1099 workers do not receive protection under their employer’s liability insurance policy which W-2 employees benefit from and therefore need to obtain their own coverage.

Many clients and companies expect independent contractors to hold liability insurance coverage before entering into a contract even though the law does not require it. A policy safeguards your finances while simultaneously increasing your professional credibility.

Freelance designers, consultants, and tradespeople can find reassurance with general liability insurance as it safeguards them against unforeseen problems.

There are a few ways to get liability insurance:

Employers and independent contractors should conduct detailed evaluations of health insurance options available to their 1099 employees. By helping their 1099 workers obtain benefits through stipends, or individual coverage plans employers can forge stronger relationships and enhance the work environment for their contractors. By providing these benefits your company stands out from competitors while attracting top talent and showing commitment to employee well-being.

1099 contractors and sole proprietors have direct enrollment access in PEO4YOU. Our subsidy calculator enables users to conduct side-by-side comparisons between PEO4YOU plans and state marketplace options so they can easily select the most affordable coverage option.

PEO4YOU provides guidance to 1099 contractors seeking top insurance alternatives and employers who want to deliver healthcare benefits to their 1099 staff members, helping them understand complex benefit structures and maintain IRS compliance.

Get in touch with PEO4YOU today to find out how we can help you!

Recent Posts

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Click To Open Modal

Get In Touch— We’re available 24/7

"*" indicates required fields

“We respect your privacy. Your contact information will be used solely for the purpose of responding to your inquiry and will not be shared with third parties.”

Thanks!

We will be in touch soon.

If you're looking to book a consultation now

Affordable health and benefits plans for small businesses, freelancers, and independent contractors.

Copyright © 2026. Peo4you. All rights reserved.