In the complex landscape of health insurance, understanding the nuances of policy structures is crucial for making informed decisions. One such critical aspect is the concept of an embedded deductible, particularly pertinent for families seeking comprehensive coverage. This article delves into the intricacies of embedded deductibles, their benefits within family health insurance plans, and the implications when an individual family member meets their deductible.

What Is an Embedded Deductible in Health Insurance?

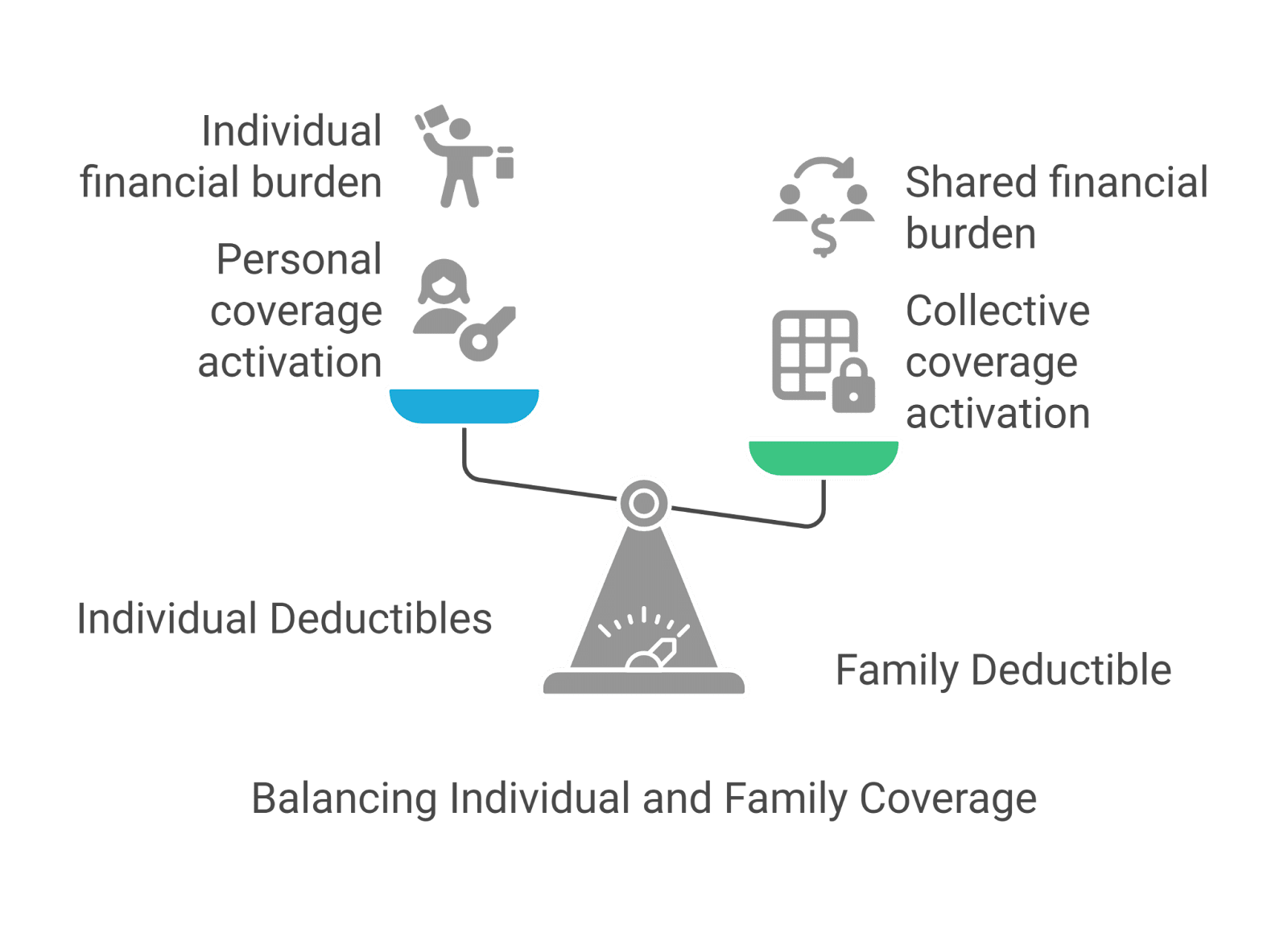

An embedded deductible refers to a health insurance policy design that incorporates individual deductibles for each family member alongside a collective family deductible. In this structure:

- Once a family member’s medical expenses reach their individual deductible, the insurance plan begins to cover a portion or all of their subsequent healthcare costs, irrespective of whether the overall family deductible has been met.

- This dual-layered approach ensures that high medical expenses incurred by one family member do not necessitate the entire family deductible to be satisfied before benefits apply.

- It provides financial protection for families by limiting the amount each individual must pay before coverage kicks in.

For instance, consider a family health insurance plan with an individual deductible of $2,500 and a family deductible of $5,000:

- If one member incurs $2,500 in medical expenses, their individual deductible is met, and the insurance starts covering eligible expenses for that person.

- This $2,500 also contributes toward the $5,000 family deductible.

- If other family members collectively incur an additional $2,500 in expenses, the family deductible is met, activating coverage for all members, regardless of whether they have met their individual deductibles.

How Does an Embedded Deductible Benefit Individuals in a Family Health Insurance Plan?

What is an embedded deductible in health insurance? Embedded deductibles offer several advantages within family health insurance plans:

- Immediate Access to Benefits: When an individual meets their deductible, they gain immediate access to insurance benefits without waiting for the entire family deductible to be satisfied.

- Financial Protection: By capping the out-of-pocket expenses for each member, embedded deductibles prevent a situation where one person’s medical costs could financially strain the entire family.

- Simplified Cost Management: Families can better anticipate and manage healthcare expenses, knowing that meeting an individual deductible triggers coverage for that member.

- More Predictability: Families can plan for out-of-pocket costs with greater accuracy since the deductible structure is clearer.

- Better Access to Care: Family members who require frequent medical attention can access their benefits sooner without waiting for the entire family deductible to be met.

- Encourages Preventive Care: Since some family members may meet their deductibles earlier, they are more likely to pursue necessary medical treatments.

For example, in a scenario where a child requires surgery costing $3,000, an embedded deductible plan with a $2,500 individual deductible ensures:

- After paying $2,500, the insurance covers the remaining $500 and subsequent expenses for that child according to its schedule of benefits (i.e. copay or coinsurance).

- The $2,500 also counts toward the family deductible, bringing the family closer to meeting the overall threshold.

- Once the family deductible is met, all members benefit from full coverage.

What Happens When One Family Member Meets Their Embedded Deductible?

What is an embedded deductible in health insurance? When a family member meets their embedded deductible:

- The insurance plan begins to cover eligible medical expenses for that individual, according to the policy’s terms.

- This coverage activation is independent of the medical expenses incurred by other family members.

- The individual who has met their deductible can access necessary healthcare services with reduced out-of-pocket costs.

- The expenses contribute toward the cumulative family deductible.

- Other family members must meet their own individual deductibles for their coverage to activate, unless the overall family deductible is met.

- Once the family deductible is satisfied through combined medical expenses, the insurance plan’s benefits extend to all members, regardless of their individual spending.

PEO4YOU: Facilitating Access to Optimal Health Insurance Plans

What is an embedded deductible in health insurance? Navigating the complexities of health insurance, including understanding embedded deductibles, can be challenging. This is where intermediaries like PEO4YOU play a pivotal role.

PEO4YOU specializes in connecting clients with health insurance companies, assisting individuals, families, and small businesses in finding comprehensive and affordable healthcare coverage.

PEO4YOU offers a range of services designed to simplify the health insurance selection process:

- Transparent and Affordable Plans:

- Ensures clients understand the specifics of their health plans without hidden fees.

- Helps clients make informed decisions aligned with their healthcare needs and financial considerations.

- Comprehensive Coverage Options:

- Provides access to a broad network of healthcare providers.

- Offers more choices and flexibility for selecting plans that suit individual or family health requirements.

By partnering with PEO4YOU, clients gain access to tailored health insurance solutions that incorporate features like embedded deductibles. Their commitment to affordability, transparency, and client support makes PEO4YOU a valuable ally in navigating the health insurance landscape.