INDIVIDUALS

Independent Health Coverage

Small Business Health Plans

Health, Vision, Dental, Life and Benefits.

Independent Health Coverage for YOU.

Protects You More than Standard Health Insurance Plans

Human-Centered Claims Managment

Human-Centered Claims Managment

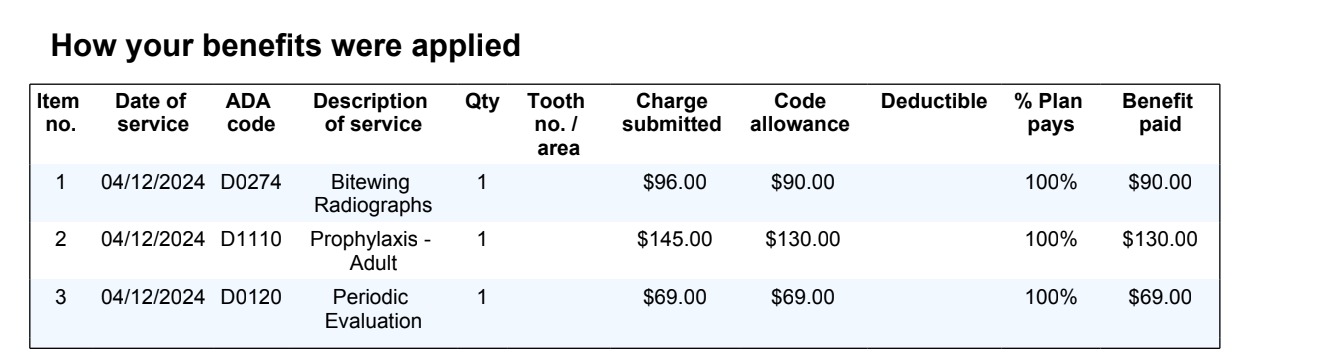

Approximately 80% of medical bills have errors such as wrong codes and duplicate charges. With PEO4YOU, you will have a dedicated representative committed to helping bring your costs down by identifying and eliminating these errors and finding you discounts and savings. Say goodbye to never-ending phone trees, transfers, and having to explain your situation over and over.

Your Premiums Work for You

Unlike traditional plans, PEO4YOU doesn’t profit from claim denials or premium hikes—ERISA laws make it illegal. We only earn from admin and union fees, so our focus stays on your care, not squeezing your wallet.

Cost Transparency & Affordable Renewals

Cost Transparency & Affordable Renewals

At PEO4YOU, keeping costs low is the goal. That’s why we offer free Teledoc visits and let you compare procedure prices before scheduling. Over the past 5 years, our rates have increased less than 16%, while others jumped 30%+ in just one year. We stay transparent so you can stay protected.

PEO4YOU = Faster, Smarter, Affordable Healthcare

Independent Health Coverage with No Delays. No Unnecessary Denials. No Wasted Dollars.

Experience Healthcare Built for You

Proactive Claim Protection

Traditional health plans often deny claims to increase profits. PEO4YOU is different. ERISA laws prohibit claim denials from turning into corporate profits. Instead, we partner with Valenz to streamline approvals and protect your access to care.

Fewer Denials, Faster Approvals, Less Stress

- 90%+ claim denials prevented before they even happen.

- Real-time coverage verification for faster approvals.

- Data-driven cost savings to lower out-of-pocket expenses.

Fast-Tracked Savings on Your Medical Bills

Valenz's advanced cost-man- agement technology proactively reduces medical expenses, ensuring you pay less for the same high-quality care. Whether it's a hospital visit or routine checkup, your costs stay lower compared to traditional plans.

Links of Interest

×

×

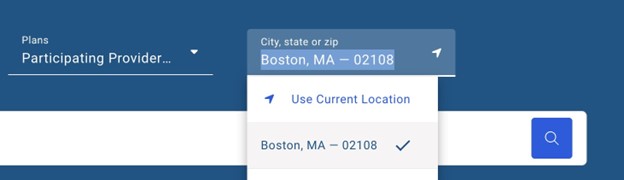

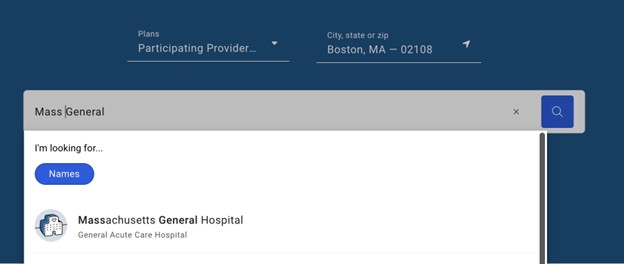

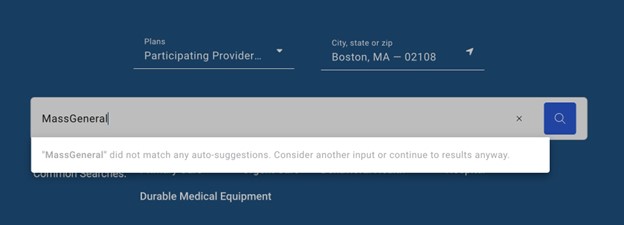

How to Find a Doctor

DO:

- Click here

-

Update the Provider City

-

Search Proper Names

- Search Name Variations

- Doctor Websites

- Name on Google

- Maiden Name

- For Double Last Names such as Manuel-Lopez try:

- Manuel

- Lopez

- Manuel-Lopez

Do NOT:

- Use Hospital or Doctor Nicknames

Independent Health Coverage

with Dental, Vision and Life Benefits are

Part of the Benefits Package

Enrollment available year round – No underwriting

| H&W 125 | DENTAL 125 | VISION 125 | LIFE 10K | ADMIN125 | Union | Total | |

|---|---|---|---|---|---|---|---|

| Employee Only | $731.00 | $65.00 | $10.00 | $5.00 | $100.00 | $27.00 | $938.00 |

| Employee + Spouse | $1,500.00 | $130.00 | $22.00 | $5.00 | $200.00 | $27.00 | $1,884.00 |

| Employee + (Children) | $1,146.00 | $130.00 | $22.00 | $5.00 | $200.00 | $27.00 | $1,530.00 |

| Employee + Family | $1,636.00 | $190.00 | $35.00 | $5.00 | $200.00 | $27.00 | $2,093.00 |

| Waived Employees | $5.00 | $27.00 | $32.00 |

Our Approach

Independent Health Coverage

Better Benefits for Independent Contractors and Companies

Freelancers

Freelancers often face high costs for individual health plans. PEO4YOU offers group plans with comprehensive benefits, making it easy and affordable to get quality coverage that suits your flexible lifestyle.

Independent Contractors

Independent workers can struggle to find affordable health insurance. PEO4YOU helps by providing access to group plans with great coverage options, offering peace of mind and financial stability without the need for a traditional employer.

Individuals

Navigating health insurance alone can be tough. PEO4YOU simplifies it with tailored group plans that lower costs and provide reliable coverage, ensuring you have the support you need without

Independent Worker

Independent Health Coverage

We provide independent health coverage comprehensive solutions for individuals and independent workers seeking reliable and affordable coverage. By offering group health plans, we ensure access to essential benefits like preventive care, specialist visits, and prescription coverage, along with additional options for dental and vision care. Our services also include life insurance to help you plan for the future and protect your loved ones. With streamlined enrollment and personalized support, we make it easy to find coverage that meets your needs without the high costs often associated with individual plans.

Health & Wellfare

Life

Dental

Vision

What should I consider when choosing an individual health plan?

When selecting a health plan, consider factors such as cost (premiums, deductibles, and out-of-pocket maximums), coverage options (including preventive care, emergency services, and prescription drugs), and network restrictions. Make sure the plan covers your preferred doctors and healthcare providers.

Can I switch health plans after enrollment?

Generally, you can switch plans during open enrollment periods, which occur annually, or if you qualify for a special enrollment period (SEP) due to life events such as marriage, birth of a child, or loss of other coverage. Make sure to review your options each year, as plans and premiums can change.

What are out-of-pocket maximums?

The out-of-pocket maximum is the most you’ll have to pay in a year for covered services. After you reach this amount, the plan covers 100% of the allowed amount for covered services. This includes deductibles, copayments, and coinsurance but not your monthly premium.

Human-Centered Claims Managment

Human-Centered Claims Managment

Cost Transparency & Affordable Renewals

Cost Transparency & Affordable Renewals